| Record Status | Pay Method = 1 | Pay Method = 13 |

|---|---|---|

| CardExpiryChanged | To update new expiration month and year | To update new expiration month and year |

|

PANChanged (Primary Account Number) |

No change—Customer needs to provide the new card info in Aria |

|

Payment Gateway Master Feature List

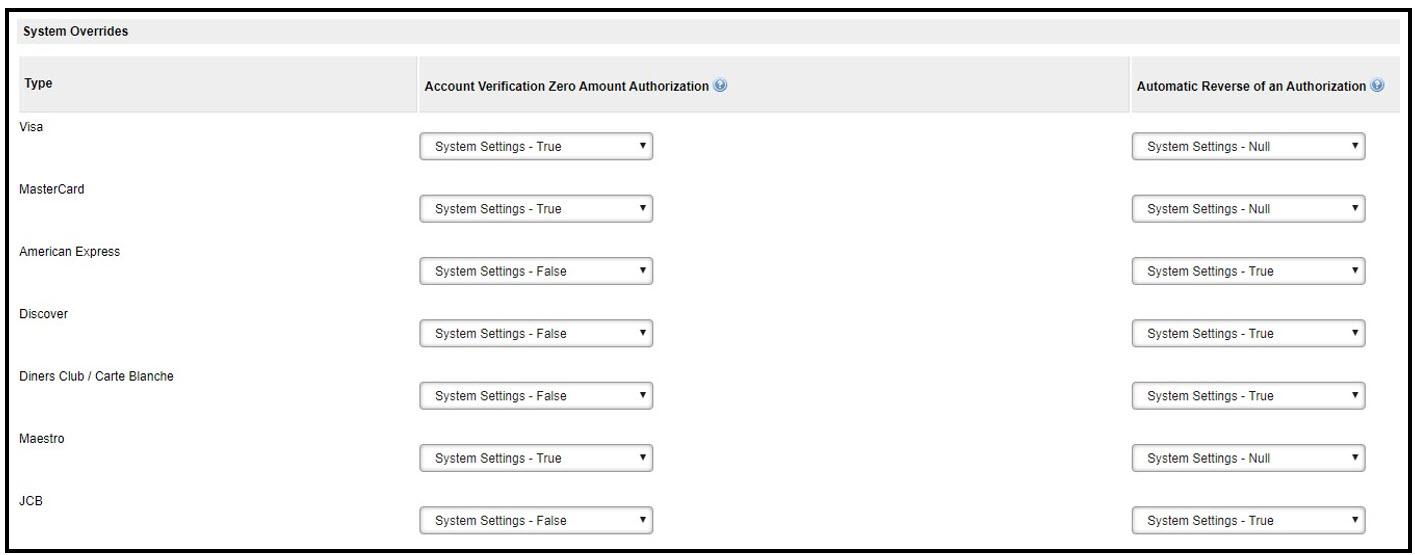

$0 Authorizations/Authorization Reversals ($0/$1)

When authorizing a card, Aria provides the option to authorize a $0 or $1 transaction on the card to ensure the card is in good standing prior to offering a service to the account. The system override settings listed in the image below are to reverse the authorizations on the card after the verifications. The settings can be enabled for all or specific card types accepted with this integration. This configuration in the UI is at the Collection Group level (Configuration > Payments > Collection Groups).

3d Secure Authentication (Manual/Dynamic)

(Currently, 3DS 2.0 supports only Visa and Mastercard. Please contact your payment gateway representative for more information.)

More information is here.

ACH Via Direct Debit

Worldline (formerly Ingenico) now supports the ACH (Automated Clearing House-Electronic Check) payment type and refund transactions through the Direct Debit payment method. Adding ACH as a payment option via Direct Debit provides another method to manage subscriptions and recurring payments in a timely and secure manner. It allows customers to pay for transactions by debiting directly from their bank account, as opposed to processing through a card brand.

To add Direct Debit with ACH as a payment method on an account, select Direct Debit as the payment type and enter the bank account details along with these two new fields:

- Bank Name

- Bank City

The Bank Name and Bank City fields added have been added at the following locations in the Aria UI:

Account > select an account > Account Overview > Payment Methods (New and Edit)

Fields appear when adding a new payment method (for Direct Debit).

Accounts > select an account > Plans > Add New Plan > Plans tab

Fields appear when adding a Primary or Backup/Secondary Pay Method Type (for Direct Debit).

Accounts > select an account > Plans > Billing Groups (New and Edit option)

Fields appear when adding a Payment Method or Secondary Payment Method (Create New Payment Method, for Direct Debit Payment Type).

Accounts > select an account > Payments and Credits > Apply a Payment

Select Alternate One-Time at the Account Level Payment Method drop-down list and select Direct Debit at the Alternate Billing Type drop-down list.

For this enhancement, two fields have been added as API inputs:

| Field | Description |

|---|---|

| <bank_name> | Bank name for the account payment method |

| <bank_city> | Bank city for the account payment method |

To process an ACH payment via Direct Debit, call any of the APIs below and pass the following information:

| Field | Value |

|---|---|

| <pay_method_type> | 26 for Direct Debit |

| <bank_name> | Bank name for the account payment method |

| <bank_city> | Bank city for the account payment method |

| <bank_country_cd> | Must be US |

The Bank Name and Bank City input fields added in support of ACH payments via Direct Debit have been added to the following APIs:

These input fields have been added to the following APIs:

- assign_acct_plan_m

- collect_from_account_m

- create_acct_billing_group_m

- create_acct_complete_m

- create_order_m

- create_order_with_plan_m

- manage_pending_invoice_m

- settle_account_balance_m

- update_acct_billing_group_m

- update_acct_complete_m

- update_acct_plan_multi_m

- update_order_m

- update_payment_method_m

Also, the "Used in Europe" Text has been removed for the <bank_branch_cd> and <bank_id_cd> input fields for these APIs.

The <bank_name> and <bank_city> fields have been also been added as outputs to the get_acct_payment_method_and_terms_m API.

The Bank Identifier Code (<bank_id_cd>) will pass the routing number value and use the Basic Bank Account Number (BBAN) (<bank_acct_num>) to pass the account number to do the ACH payment via Direct Debit. The Bank Identifier Code field is also now validated for length and character format for the Direct Debit payment method only when the Bank Country (the two-character <bank_country_cd>) is passed as US (ACH payments via Direct Debit are only supported for US banks at this time).

The Bank Swift Code (<bank_swift_cd>) input field (with validation on the length and character format) is now used in support of the Direct Debit payment method. It is required for the International Bank Account Number (IBAN).

Account Updater

The Adyen account updater proactively sends information to Aria from Visa and Mastercard which will automatically update card information and decrease the possibility of card declines. Currently Adyen only supports this feature for Visa and MasterCard.

The updater has been enhanced to support both credit card (pay method = 1) and tokenized credit card (pay method = 13) transactions.

This includes the following status enhancements:

Email Template Updates

A new Email template class has been introduced (message class C3) called "Credit Card Update Required." This notifies the account holder that their account number has changed and no longer matches the credit card on file.

For more information on Email template classes, please click here.

Four replacement strings have been added under the Billing category to be used with the Credit Card Update Required Email template. They are as follows:

- insertPaymentMethodNo—This is used to print the sequence number of the account’s payment method (similar to the insertCurrentBillSeq used for Aria 6).

- insertClientPaymentMethodId—This is used to print the Client Defined Payment Method ID for the sequence number of the account’s payment method.

- insertPaymentMethodName—This is the means of making the payment (Credit Card, Tokenized Credit Card, Direct Debit, Net Terms, etc.).

- insertPaymentMethodDescription—This is the description of the payment method name that provides further detail on the terms of payment (Payments to be processed with NETS, Accounts have 15 days to pay balance before entering dunning, etc.).

For more information on creating Email templates, please click here.

Event Notification Updates

Two events have been added in support of the Adyen Account Updater (under the Account and Master Plan Instance Notifications class). They are:

| Event Name | Description |

|---|---|

| Account Message Type “Credit Card Update Required” Requires Sending | System determination that account message type “Credit Card Update Required” requires sending. |

| Message Type “Credit Card Update Required” Sent to Account Holder | Account message type “Credit Card Update Required” was sent to account holder. |

To view events in the Account and Master Plan Instance Notifications class, please click here.

Note: The Credit Card Update Required Email template (message class C3) and two events noted above will only be used for the Adyen account updater.

Generating the Refresh Token

The refresh_token_from_pmt_processor_m API call is used to get the updated suffix, expiry_mm and expiry_yyyy (using existing token) from Adyen when the PAN changes for the Tokenized Credit Card (for Pay Method = 13 at the <payment_method_no> or <client_payment_method_id> input fields).

More on the Account Updater is here.

API Endpoints

Worldline (formerly Ingenico) and Vantiv have updated their API end points for both pre-production and production environments, as shown: The Worldline (formerly Ingenico) details are as follows:

- Pre-Production:

api.preprod.connect.worldline-solutions.com - Production:

api.connect.worldline-solutions.com

To enter the updated endpoint, go to Configuration > Payments > Payment Gateways > Processor/Gateway Details > API Base URL.

Auto-Reverse Payment Authorization

If you performed multiple authorizations and want to reverse one of them, you must specify which authorization to reverse by referencing the authorization ID.

Back-End Processors

- Backend-processor-specific configuration for associated Collection Account Groups

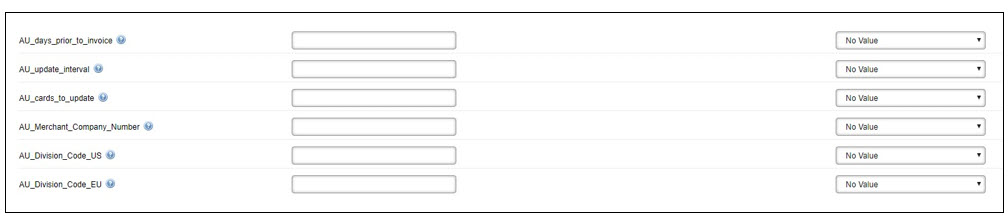

Batch Account Updater

Account updater automatically updates your account holders’ card information. This feature is available for Visa and MasterCard transactions in North America. To utilize this feature with Chase Paymentech, you will need to set up a separate merchant account with Chase. Once set up, this configuration lies within the collection groups and payment gateways tab in the UI (Configuration > Payments).

Bulk Collection Support

Vantiv allows you to collect from multiple accounts using API call settle_account_balance_bulk_m. This parameter allows for the batch submission of up to 5,000 accounts to Vantiv for collection attempts on each account. The batch process runs every 30 minutes. All transactions that were sent to Aria within that time are sent to Vantiv for collection. To determine the maximum number of records allowed in this call, Aria’s customer support team needs to set the parameter <maximum_records_allowed_in_a_bulk_settle_api_call> at the number of your choosing.

The output fields of this call are:

- <error_code> - Aria-assigned error identifier (0 indicates no error has occurred)

- <error_msg> - Description of any error codes. (OK indicates there are no errors)

Card-Specific System Overrides

This gateway enables the override of card-specific data stored within the relevant fields of the Aria UI or the API processing a payment.

Cardholder-Initiated Transactions (CIT)/Merchant-Initiated Transactions (MIT)

This feature sends flags distinguishing cardholder initiated transactions (CIT) and merchant initiated transactions (MIT) within the <recurring_processing_model_ind> parameter of the following API calls:

- assign_acct_plan_m

- authorize_electronic_payment_m

- cancel_acct_plan_m

- collect_from_account_m

- create_acct_billing_group_m

- create_acct_complete_m

- create_order_m

- create_order_with_plan_m

- manage_pending_invoice_m

- replace_acct_plan_m

- settle_account_balance_m

- update_acct_billing_group_m

- update_acct_complete_m

- update_acct_plan_m

- update_acct_plan_multi_m

- update_payment_method_m

- validate_acct_fraud_scoring_m

This feature is applicable for both credit cards (Visa, MasterCard and Discover) and tokenized credit cards.

The input values for the <recurring_processing_model_ind> are the following:

- Cardholder-Initiated Transaction—Credentials on File: a credit card transaction initiated by the cardholder for a new order or a Plan upgrade that uses a credit card that is currently stored in Aria. (Default)

- Cardholder-Initiated Transaction—a credit card transaction initiated by the cardholder for a new account or creating an order that uses an alternate credit card that is not currently stored in Aria.

- Merchant-Initiated Transaction—Standing Instruction—Recurring: a credit card transaction initiated by Aria’s clients for a recurring charge that uses a credit card that is currently stored in Aria.

- Merchant-Initiated Transaction—Unscheduled Credentials on File: a credit card transaction initiated by Aria’s clients for a non-recurring charge (one-time order or Plan upgrade) that uses a credit card that is currently stored in Aria.

The output field of this call is <proc_initial_auth_txn_id>. For Visa and Mastercard, Adyen is passing the networkTxReference that Aria will capture and pass for subsequent MIT transactions. At this time, Adyen is not passing this value for Discover cards.

For Vantiv and PayPal Payflow Pro, cards are Visa, Mastercard, and Discover.

Card Verification Value (Sending CVV Only Through the API)

For recurring transactions, Vantiv supports a feature to send the CVV number (without the card number) for collection. The following API calls support this feature:

The input parameter <existing_pay_method_cvv> within the above API calls will send the CVV on a stored card directly to Vantiv. If using the parameter <alt_pay_method_m>, the parameter <existing_pay_method_cvv> is ignored and the CVV of the <alt_pay_method_m> is used.

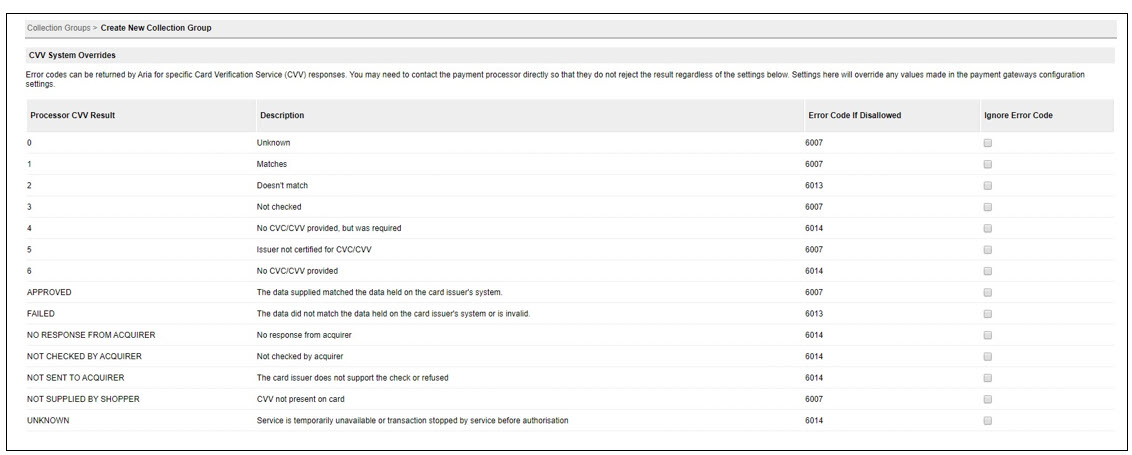

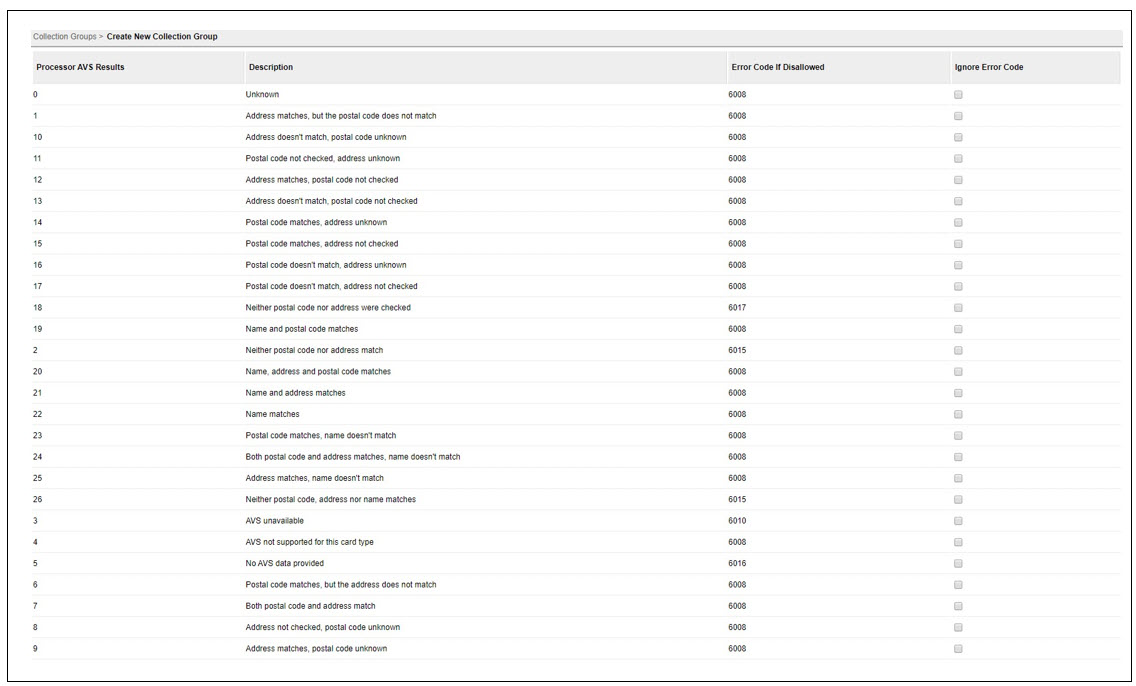

Card Verification Value (CVV)/Address Verification Service (AVS)

With this integration, error codes can be returned by Aria for a specific Card Verification Value (CVV) response. This configuration lies within the collection groups and payment gateways tab in the UI (Configuration > Payments > Collection Groups):

This integration also offers Address Verification Service responses. This configuration is also within the collection groups and payment gateways tab of the UI. See image below for possible configuration options:

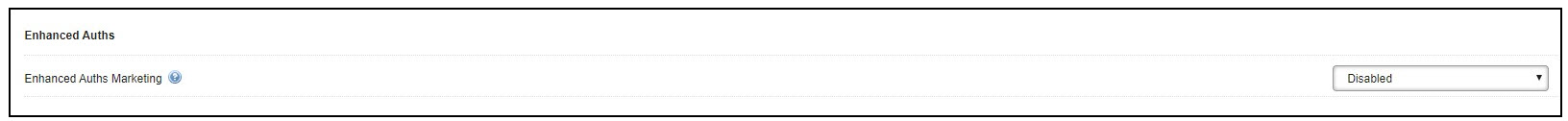

Enhanced Auths Marketing

This customer insight feature is designed to provide additional information to merchants, allowing them to improve authorization approval rates and lower the total cost of payments. You can configure this setting at the Payment Gateway or Collection Group level in the UI. This feature is available for authorizations, verifications and payments of the following payment methods of all Chase supported card types:

- Credit card (pay_method=1)

- Tokenized credit card (pay_method=13)

The following APIs contain the <perform_marketing_insights_inquiry> parameter:

The input values for <perform_marketing_insights_inquiry> are the following:

- NULL or -1: Use client-defined settings

- 0: do not return

- 1: Return

For direct post, the “marketing insights” field is located under the USS Reg configuration settings.

The output values of <perform_marketing_insights_inquiry> are the following:

- proc_prepaid_indicator—identifies the card as a prepaid card (if available).

- proc_prepaid_available_balance—available balance on the prepaid card.

- proc_prepaid_card_type - categorizes the type of prepaid card (if available).

- proc_issuing_country - indicates issuing country for the card.

- proc_affluence_type - indicates if card is affluent.

- proc_card_product_type - indicates whether the submitted card is a commercial or consumer card.

- proc_signature_debit_ind—identifies the card as a signature debit card.

- proc_pinless_debit_ind—identifies the card as PIN less-debit-eligible.

- proc_durbin_regulated_ind—identifies the card as Durbin Regulated.

Enhanced Collection Support - Japanese Yen and Indian Rupee

When collecting a payment with Vantiv that is using either the Japanese Yen or Indian Rupee, no decimal points are added to the payment amount if a whole value is requested.

Example: If attempting to collect $15 using JPY, 15 will be collected and not 1500 ($15.00).

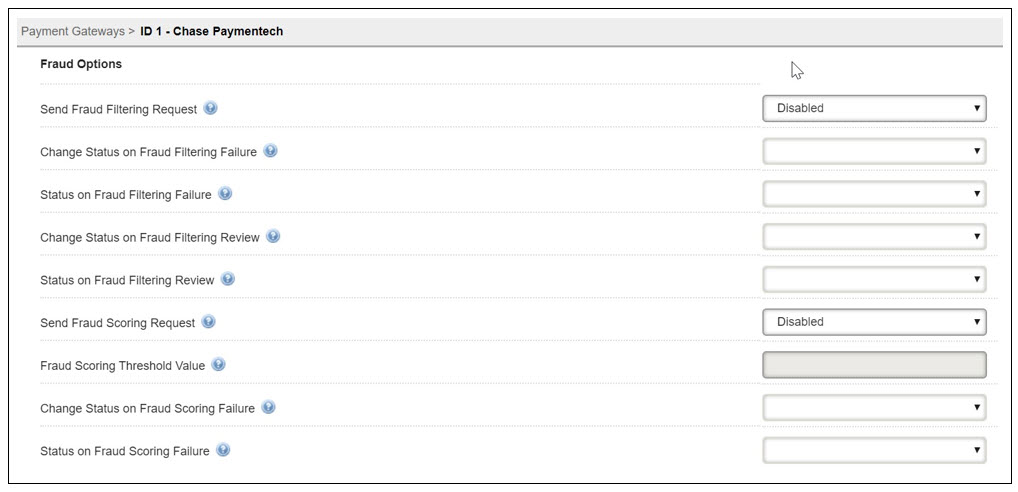

Fraud Protection

Chase allows fraud scoring and filtering protection. To use these features with Aria you will need to enable them with Chase Paymentech. In addition, you will need to use the applicable fraud merchant ID and division code for the fraud protection features you need. These values should be inserted in the applicable fields within the UI at both the payment gateway and collection group levels. At the payment gateway and collection group levels, the below fraud options are available for selection. Each option has a corresponding tool tip to assist in your selections.

For improved fraud scoring, we recommend that you send the below data to Chase when you create or update an account:

- Customer_ip_address

- Customer_browser

- Fraud_merchant_id

- Customer_gender

These fields are normally passed via the API however they can be set in the UI under field options at the payment gateway level and advanced options at the collection group level.

If you are using direct post, fraud scoring and filter options should be set at the USS Reg Configuration level. Each option has a corresponding tool tip to assist in your selections. Based on your selected fraud options and your configuration in Chase the specified actions will be taken on accounts handled by your applications that use Direct Post.

Your Chase Paymentech representative will provide more information and additional documentation if needed.

Fraud Scoring/ThreatMetrix

The Vantiv (Litle) integration with Aria allows for fraud scoring features on credit cards, direct debit, electronic check and tokenized credit cards. Vantiv has partnered with ThreatMetrix to provide additional fraud support. Once enabled with Vantiv, they will provide you a ThreatMetrix value. The 5-character prefix should be placed in the below field at both the collection group and payment gateway levels.

Once the prefix is filled in, the additional fraud options should be selected under “gateway options” at the payment gateway level and collection group options at the collection group level. Each option has a corresponding tool tip to assist in your selections.

Geo Code Support

This feature enhances Aria's integration with the Sovos tax engine, implementing the Geo code support to calculate taxes for accounts' Ship To, Bill To, Ship From, and Bill From addresses instead of the full addresses.

Unlike traditional postal codes, such as a ZIP code, a Geo Code is not a subjective descriptor, but a series of letters and/or numbers based on the physical location, or latitude and longitude coordinates, of a business, residence, or even point of interest. A Geo Code can provide every location in the world with an internationally unique and permanent "address." Beyond supplying a physical address to residents and businesses located in countries without addressing systems, a common Geo Code standard can greatly facilitate international communications and transactions.

For the Ship From, Bill From, Ship To and Bill To address types, Aria will send the Geo Codes/addresses to the Sovos tax engine in the following order:

- The Geo Code of the respective Ship From, BIll From, Ship To and Bill To addresses

- The respective Ship From, BIll From, Ship To and Bill To addresses

- The Geo Code of the account's taxable address

- The account's taxable address

The following outputs have been added for the API calls listed below. They denote the tax address method code used to generate the geocode of the address:

| API | Output Parameters |

|---|---|

| get_acct_billing_group_details_m |

<bill_addr_method_cd> |

| get_acct_contacts_m |

<addr_method_cd> |

| get_acct_details_all_m | <addr_method_cd> <bill_addr_method_cd> <stmt_addr_method_cd> |

| get_acct_hierarchy_details_m | <addr_method_cd> <bill_addr_method_cd> <stmt_addr_method_cd> |

| get_acct_payment_methods_and_terms_m | <bill_addr_method_cd> |

| refresh_token_from_pmt_processor_m | <bill_addr_method_cd> |

Note: The Geo Code has no expiration once it is generated.

High-Precision Usage

The Vantiv integration allows for usage reporting. The high-precision usage reporting feature allows up to a 12-digit (excluding decimal points) reporting quantity when reporting the usage to Vantiv.

Instant Payment Notification

Instant Payment Notification (IPN) provides you with immediate updates about changes to the status of payments. You can then take your chosen action on a purchase such as activating service or providing the account holder with the order status.

Level 2 and 3 Customer Data

When applicable, Aria will send Level 2 and 3 data to the payment gateway, resulting in savings on transaction fees. We will pass level 2 and 3 data for the following payment methods:

- Credit Card (pay_method=1)

- Visa (cc_id= 1)

- MasterCard (cc_id=2)

- Tokenized credit card (pay_method=13)

Once received, the payment gateway will filter and or reformat the data as necessary to confirm eligibility. The gateway does not allow more than 9 line items of Level 3 data to pass at one time. Aria has limited the maximum line item to 9 to avoid collection errors from the gateway.

Merchant Specific Gift Card

This feature adds Aria support for a new payment method, "Merchant Specific Gift Card," for Vantiv clients only. This pay method shares data fields with credit cards, with the additional ability to request the remaining balance via supporting API calls and Direct Post configurations.

To take advantage of this feature, you must first enable this feature on the Vantiv side of your configuration. Once configured in both Vantiv and Aria, Aria sends gift-card-related data to, and receives gift-card-related data from, Vantiv via API calls.

Add Vantiv (Litle) Payment Gateway

Getting here: Configuration > Payments > Payment Gateways

- Click the New button

- Select Vantiv (Litle)

- Complete Vantiv (Litle) Payment Gateway configuration.

Adding "Merchant Specific Gift Card" Pay Method

Getting here: Configuration > Payments > Payment Methods

- Click the New button.

- Select Merchant Specific Gift Card from the Select a Method drop-down menu.

- Complete Pay Method setup per documentation.

Configuring Direct Post Behavior for "Merchant Specific Gift Card"

Getting here: Configuration > Client Settings > USS Reg Configuration

- Click the New button.

- Complete the Direct Post configuration.

- Choose "True" or "False" for the new field, Perform balance inquiry.

True: The return from a Direct Post call will include the remaining balance for Pre-paid/Gift cards.

False: The return from a Direct Post call will not include the remaining balance for Pre-paid/Gift cards.

Specifying "Merchant Specific Gift Card" as an Account's Pay Method

You can specify "Merchant Specific Gift Card" as an account's pay method in the following ways:

- Via API calls.

- Via the UI, on the Payment Methods tab on the Account Overview of an existing account.

- Via the UI, on the Collect Payment Electronically screen.

- Via the UI, on the Create New Account screen.

- Via the UI, when creating a new Billing Group.

Recurring Flag

Aria now sends the recurring flag (to identify a transaction associated with a subscription billing model) to the Braintree payment gateway only after a successful payment transaction. This is required to comply with Visa and MasterCard's rules that apply to Braintree.

Recurring Transaction Indicators

Initial and recurring transaction types are automatically set to recurring when the field values are set to “true” under the recurring options settings in the UI (when creating a Payment Gateway). This feature may result in lower transaction fees. The recurring transaction indicators can be configured at both the Payment Gateway and Collection Group levels (Configuration > Payments).

Refund Responses

Aria supports the following Adyen Notifications for eligible payment methods:

- Authorization

- Capture

- Cancellation

- Capture Failed

- Refund

- Refund Failed

For Worldline (formerly Ingenico), Aria now sends the Refund ID (refund's payment id) instead of the original payment id (payment's payment id) in the 'merchantReference' field while making a refund request to Worldline.

SCA 3DS Exemption

A new setting has been added under Options at the payment gateway and collection group level for a low-value payment strong customer authentication (SCA) exemption (for 3DS-enabled merchants). The default selection for this field is No Exemption. Using this setting, a customer will not get a pop-up confirmation message for the 3DS transaction under the exempted amount and currency, which will ensure more seamless transaction processing. To access the payment gateway, navigate as follows in the Aria UI: Configuration > Payments > [Payment Gateways][Collection Groups]. The exception amount is 30 Euros.

Create a new Payment Gateway or Collection Group and select Low Value Payment from the Exemption Type field as shown:

Note: Clients need to work with their payment gateway for enabling the low amount value SCA exemption feature for their merchants.

For Direct Post, an SCA Exemption textbox field has been introduced in the USS Reg Configuration (Configuration > Client Settings > USS Reg Configuration), as shown:

Clients can specify the following values:

- 0—Do not apply exemption. Process transaction via 3D Secure.

- 1—Apply the exemption and skip 3D Secure Authorization.

- -1—Use Payment Gateway or Collection Group settings for exemption rules.

For APIs, client can specify low amount exemptions in the <proc_field_override> array of the following APIs:

Soft Descriptors

The <soft_descriptor> input to the create_order_m API supports the Visa subscription regulations update. This can support "authorization" and "payment" actions for the following card types: Visa, MasterCard, American Express, and Japan Credit Bureau (JCB).

The soft descriptor configuration allows for a transaction description to be shown on the buyer’s credit card statement. This field allows for a Merchant Name or Item Description of a specified length when paying by credit card (25 characters for Visa, American Express and JCB and 23 for MasterCard). This field is normally passed via the API; however, it can be set in the UI at the payment gateway or collection group level.

The soft_descriptor field can be configured in the UI as shown (example below is for Chase Paymentech):

Configuration > Payments > Payment Gateways > Field Options:

Configuration > Payments > Collection Groups > Advanced Options:

Note: If the soft_descriptor value is blank when running an API listed in this section, then the value configured in either of the Aria UI dialogs will be used (the Collection Group value takes precedence over the Payment Gateway value).

Standalone Credit

This gateway can create a stand-alone credit when a refund cannot otherwise be created. Creating a stand-alone credit posts a credit to the payment card on file for the transaction and posts a stand-alone credit for the refund amount instead of issuing a true refund.

Support for Fraud Tools, Revenue Protect +

Aria supports Adyen's RevenueProtect+, a fraud protection mechanism. The API validate_acct_fraud_scoring_m now sends fraud-related customer data to Adyen's customizable rules engine to return more granular fraud scoring for payment transactions.

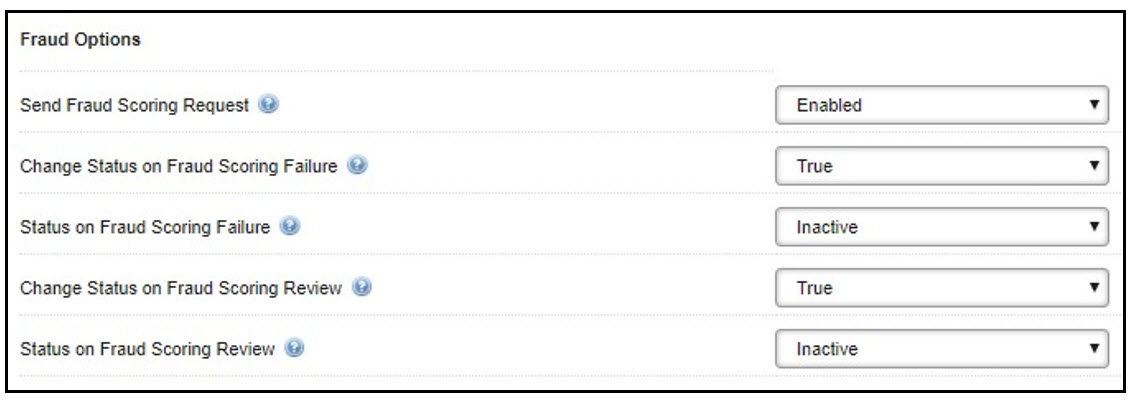

After you have configured the Adyen Payment Gateway in Aria, a “Fraud Options” section appears on the Gateway Options Tab (see image below).

Details on the fraud options are as follows:

- Send Fraud Scoring Request: When set to true, Aria sends a request to Adyen to return fraud scoring information. If the fraud score returned is below the Fraud Scoring Threshold or the Fraud Score response is "Not Successful," Aria modifies the status based on "Change Status on Fraud Scoring Failure" setting. "Send Fraud Scoring Request" must be set to "True" to enable the "Change Status on Fraud Scoring Review" menu.

- Change Status on Fraud Scoring Review: When set to true, Aria changes the status of the Master Plan Instance(s) to the value selected on the "Status on Fraud Scoring Review" drop-down menu, and the Fraud Score response is "Review." "Change Status on Fraud Scoring Review" must be set to "True" to enable the "Status on Fraud Scoring Review" drop-down menu.

- Status on Fraud Scoring Review: This parameter governs the behavior for changing the status when Fraud Scoring is enabled and Change Status on Fraud Scoring Review is set to "True."

Transaction Reference IDs

Aria will parse unique transaction reference IDs returned from the payment gateway in the <proc_payment_id> parameter for declined transactions. Transactions include but are not limited to the following:

- Payments

- Authorizations

- Captures

- Voices

- Reverses

- Refunds

- Balance Inquires

If no reference ID is returned from the payment gateway, Aria returns a NULL value for <proc_payment_id>. The following API calls include the <proc_payment_id> output parameter:

- create_acct_complete_m

- update_acct_complete_m

- create_order_with_plan_m

- create_order_m

- assign_acct_plan_m

- replace_acct_plan_m

- update_acct_plan_m

- update_acct_plan_multi_m

- settle_account_balance_m

- collect_from_account_m

- authorize_electronic_payment_m

- validate_payment_information_m

- validate_acct_fraud_scoring_m

- gen_rb_m

- manage_pending_invoice_m

Tokenized ACH

A new Tokenized Automated Clearing House (ACH) payment method has been introduced as part of Aria’s integration with selected payment gateways including Braintree. ACH payment tokenization adds another level of data security in that sensitive account and number routing data is replaced by a random string of alphanumeric data stored in a reference token. The ACH processor has the full account and routing number securely stored and, using the matching token, processes the ACH transaction.

This payment method can be accessed from the following locations within the Aria application:

- Account Payment Methods (Accounts > [search for an account] > Payment Methods > New Payment Method > Payment Type)

- Billing Groups (Accounts > [search for an account] > Plans > Billing Groups > New Billing Group > Payment Method/Secondary Payment Method)

- Payment Methods (Configuration > Payments > Payment Gateways > Braintree > Field Options)

- Collection Groups (Configuration > Payments > Collection Groups > Braintree > Advanced Options)

Note: To complete the Tokenized ACH payment, configuring notification settings is mandatory in the Braintree Portal. If a client is opting to use the Tokenized ACH payment method for making payments, for the initial online transaction, they will receive the status as “Pending Settlement.“ After 3 to 5 business days, Braintree will move the payment status to “Settled “or “Settlement Declined.“ Aria will be notified only when the following notification URL is configured in the Braintree portal.

https://secure.<environment>.ariasystems.net/api/alter_payment_status.php/client_no/<client_no>

Note: If either <bank_acct_num>,<bank_routing_no> or <agreement_id> is not provided in the API call, the following error is generated:

| Error Code | Description |

| 4044 | Missing a required value. Please check that either the bank_account_no, bank_routing_number or agreement_id is present. |

The Tokenized ACH Payment method is supported by the following APIs:

- assign_acct_plan_m

- collect_from_account_m

- create_acct_billing_group_m

- create_acct_complete_m

- create_order_m

- manage_pending_invoice_m

- settle_account_balance_m

- update_acct_billing_group_m

- update_acct_complete_m

- update_acct_plan_multi_m

- update_order_m

- update_payment_method_m

Tokenized Credit Card Expiry Notifications

Aria will store the last four digits of a credit card along with the card’s expiration dates (month and year) from the tokenized credit card being used for a transaction. These details need to be received as inputs along with the < bill_agreement_id> from the following parameters:

If these details are not received as inputs, then Aria will collect this info from the payment gateways using the <bill_agreement_id>. The credit card expiry notification emails will be sent for accounts where <pay_method_type> is 13.

UI Configuration Fields

Getting Here: Add or edit a payment gateway and/or collection group.

- Merchant ID: The unique identifier for your Gateway Account, which is different than your merchant account ID.

- Public Key: A user-specific public identifier.

- Private Key: A user-specific secure identifier that must not be shared, even with your payment gateway.

Note: These credentials can be found in the Production Control Panel for your payment gateway.

- CVV not provided: To authorize tokenized credit cards, select Ignore Error Code to avoid errors when you call an API to add a token that was previously created outside of Aria.

Vantiv Connector

Prerequisites

If you use Vantiv as your payment gateway and you plan to use tokenized credit cards as a payment method, you must enable the register token feature in Vantiv.

The Vantiv Connector automatically pushes level 3 data for credit card transactions. If level 3 data is unavailable, Ari seamlessly degrades to sending only level 2 or level 1 data, as appropriate.

Fields

- API Username: The API Username provided by Vantiv.

- API Password: The API Password provided by Vantiv.

- Merchant ID: The Merchant ID provided by Vantiv.

- Litle Reporting Group: Defines how the transactions appear in the Reporting UI. Depending on how you want to group the transactions you send, Vantiv can provide guidance on how best to name this field to fit your reporting needs.

- URL for Online Processing: The URL for Online Processing provided by Vantiv.

- URL for Batch Processing: The URL for Batch Processing provided by Vantiv.

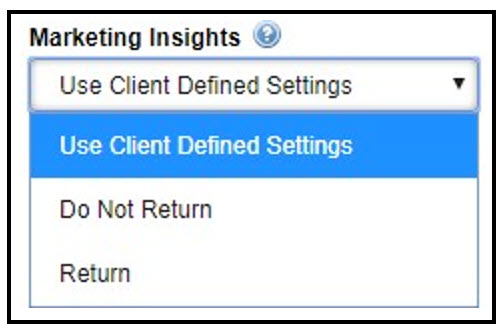

Vantiv Insights (Marketing Information)

This customer insight feature is designed to provide additional information to merchants, allowing them to improve authorization approval rates and lower the total cost of payments. You can configure this setting at the payment gateway or collection group levels under Vantiv Insights or USS Reg Configuration under marketing insights. This feature will provide information regarding prepaid indicators, affluence indicators, issuer country indicators and card type indicators of the following payment methods:

- Credit card (pay_method=1)

- Tokenized credit card (pay_method=13)

The following APIs contain the <perform_marketing_insights_inquiry> parameter: