The Vantiv (Litle) integration with Aria allows for fraud scoring features on credit cards, direct debit, electronic check and tokenized credit cards. Vantiv has partnered with ThreatMetrix to provide additional fraud support. Once enabled with Vantiv, they will provide you a ThreatMetrix value. The 5-character prefix should be placed in the below field at both the collection group and payment gateway levels.

Vantiv (Litle)

Note: Vantiv merged with Worldpay in 2019.

Supported Features

- Fraud scoring (using ThreatMetrix)

- Vantiv Insights (marketing information)

- Supported Payment Methods

- Sending Card Verification Value (CVV) only through the API

- Bulk Collection Support

- Enhanced Collection Support for Japanese Yen and Indian Rupee

- High-Precision Usage

- Soft Descriptors

- Level 2/3 Data

- Transaction Reference IDs

- Cardholder Initiated Transactions (CIT) and Merchant Initiated Transactions (MIT) for Visa, Mastercard, and Discover credit cards

- $0 Authorization/Authorization Reversals

- Card Verification Value (CVV)/Address Verification Service (AVS) Configuration

- Mail Order/Telephone Order (MOTO) Enhancement

- Response Code Enhancement

- Soft Failure Messaging for Visa Card Transactions

Fraud Scoring

Once the prefix is filled in, the additional fraud options should be selected under “gateway options” at the payment gateway level and collection group options at the collection group level. Each option has a corresponding tool tip to assist in your selections.

Vantiv Insights

This customer insight feature is designed to provide additional information to merchants, allowing them to improve authorization approval rates and lower the total cost of payments. You can configure this setting at the payment gateway or collection group levels under Vantiv Insights or USS Reg Configuration under marketing insights. This feature will provide information regarding prepaid indicators, affluence indicators, issuer country indicators and card type indicators of the following payment methods:

- Credit card (pay_method=1)

- Tokenized credit card (pay_method=13)

The following APIs contain the <perform_marketing_insights_inquiry> parameter:

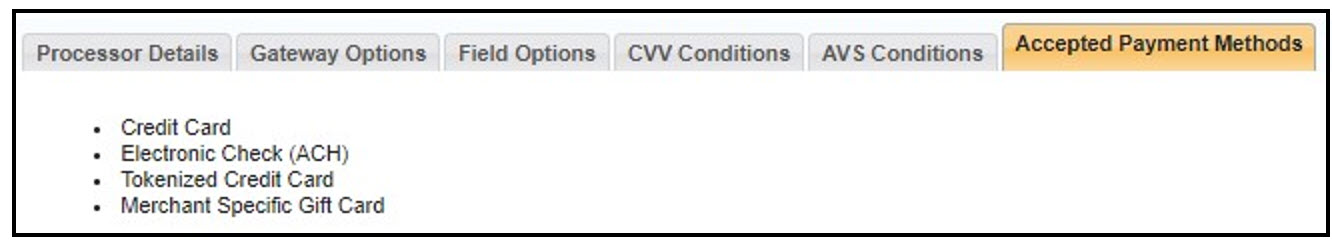

Supported Payment Methods

The following payment methods are accepted with the Vantiv/Aria integration:

| Traditional Payment Methods | Cards |

|---|---|

| Credit Card | Visa |

| Electronic Check (ACH) | MasterCard |

| Tokenized Credit Card | American Express |

| Merchant-Specific Gift Card | Discover |

| Diners Club/Carte Blanche | |

| JCB |

These are listed on Knowledge Central along with the UI for the accepted payment methods at the payment gateway level (Configuration > Payments):

The Vantiv integration allows merchant specific gift card as an accepted traditional payment method. This method is accepted via supported API calls and direct post configurations. Within <payment_method_type> value 40 should be chosen to use merchant specific gift card as the payment type.

Sending CVV only through the API

For recurring transactions, Vantiv supports a feature to send the CVV number (without the card number) for collection. The following API calls support this feature:

The input parameter <existing_pay_method_cvv> within the above API calls will send the CVV on a stored card directly to Vantiv. If using the parameter <alt_pay_method_m>, the parameter <existing_pay_method_cvv> is ignored and the CVV of the <alt_pay_method_m> is used.

Bulk Collection Support

Vantiv allows you to collect from multiple accounts using API call settle_account_balance_bulk_m. This parameter allows for the batch submission of up to 5,000 accounts to Vantiv for collection attempts on each account. The batch process runs every 30 minutes. All transactions that were sent to Aria within that time are sent to Vantiv for collection. To determine the maximum number of records allowed in this call, Aria’s customer support team needs to set the parameter <maximum_records_allowed_in_a_bulk_settle_api_call> at the number of your choosing.

The output fields of this call are:

- <error_code>—Aria-assigned error identifier (0 indicates no error has occurred)

- <error_msg>—Description of any error codes. (OK indicates there are no errors)

Enhanced Collection Support for Japanese Yen and Indian Rupee

When collecting a payment with Vantiv that is using either the Japanese Yen or Indian Rupee, no decimal points are added to the payment amount if a whole value is requested.

Example: If attempting to collect $15 using JPY, 15 will be collected and not 1500 ($15.00).

High-Precision Usage

The Vantiv integration allows for usage reporting. The high-precision usage reporting feature allows up to a 12-digit (excluding decimal points) reporting quantity when reporting the usage to Vantiv.

Soft Descriptors

The soft descriptor configuration allows for a transaction description to be shown on the buyer’s credit card statement. Under field options at the payment gateway level and advanced options at the collections group level are specific configurations related to soft descriptors. Fields customBilling/phone (soft_descriptor_customer_service) and customBilling/descriptor (soft_descriptor) should be configured to show on the buyer’s credit card statement. Each option has a corresponding tool tip to assist in your selections. Each field listed below has a drop-down list next to it. These values are comprised of account fields that have been configured in your Aria instance.

*Note: Constant Contact receives the data directly, makes modifications and then sends the data to Vantiv.

Level 2/3 Data – Gateway Configurations

The Vantiv connector will automatically push level 3 data for all credit card transactions. If level 3 data is not available for that transaction, Aria will send level 2 if available or switch to level 1 data if neither 2 or 3 are available.

Transaction Reference IDs

Aria will parse unique transaction reference IDs returned from Vantiv in the <proc_payment_id> parameter for declined transactions. Transactions include but are not limited to the following:

- Payments

- Authorizations

- Captures

- Voices

- Reverses

- Refunds

- Balance Inquires

If no reference ID is returned from Vantiv, Aria returns a NULL value for <proc_payment_id>. The following API calls include the <proc_payment_id> output parameter:

- create_acct_complete_m

- update_acct_complete_m

- create_order_with_plan_m

- create_order_m

- assign_acct_plan_m

- replace_acct_plan_m

- update_acct_plan_m

- update_acct_plan_multi_m

- settle_account_balance_m

- collect_from_account_m

- authorize_electronic_payment_m

- validate_payment_information_m

- validate_acct_fraud_scoring_m

- gen_rb_m

- manage_pending_invoice_m

Cardholder Initiated Transactions (CIT) and Merchant Initiated Transactions (MIT) for Visa, Mastercard, and Discover

This feature sends flags distinguishing cardholder initiated transactions (CIT) and merchant initiated transactions (MIT) within the <recurring_processing_model_ind> parameter of the following API calls:

- assign_acct_plan_m

- authorize_electronic_payment_m

- cancel_acct_plan_m

- collect_from_account_m

- create_acct_billing_group_m

- create_acct_complete_m

- create_order_m

- create_order_with_plan_m

- manage_pending_invoice_m

- replace_acct_plan_m

- settle_account_balance_m

- update_acct_billing_group_m

- update_acct_complete_m

- update_acct_plan_m

- update_acct_plan_multi_m

- update_payment_method_m

- validate_acct_fraud_scoring_m

The input values for the <recurring_processing_model_ind> are the following:

- 0: Cardholder-Initiated Transaction—Credentials on File: a credit card transaction initiated by the cardholder for a new order or a plan upgrade that uses a credit card that is currently stored in Aria. (Default)

- 1: Cardholder-Initiated Transaction—a credit card transaction initiated by the cardholder for a new account or creating an order that uses an alternate credit card that is not currently stored in Aria.

- 2: Merchant-Initiated Transaction—Standing Instruction – Recurring: a credit card transaction initiated by Aria’s clients for a recurring charge that uses a credit card that is currently stored in Aria.

- 3: Merchant-Initiated Transaction—Unscheduled Credentials on File: a credit card transaction initiated by Aria’s clients for a non-recurring charge (one-time order or plan upgrade) that uses a credit card that is currently stored in Aria.

The output field is <proc_initial_auth_txn_id>. This feature is available for Visa, MasterCard, and Discover.

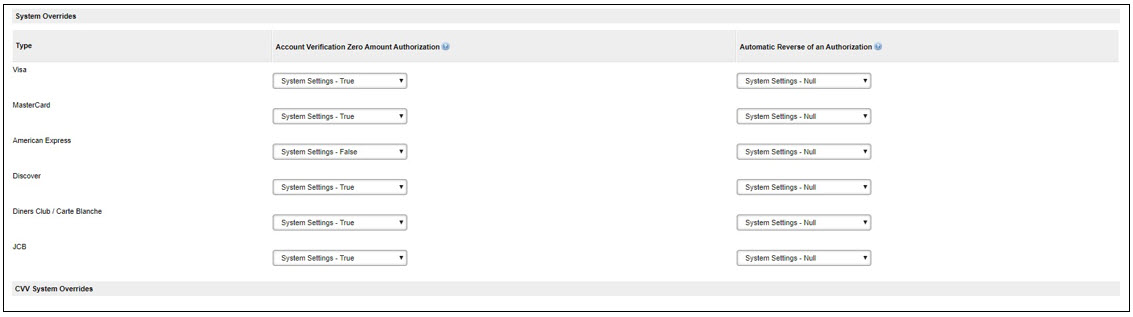

$0 Authorization/Authorization Reversals

When authorizing a card, Aria provides the option to authorize a $0 or $1 transaction on the card to ensure the card is in good standing prior to offering a service to the account. The system override settings listed in the image below are to authorize and then reverse the authorizations on the card after the verifications. The settings can be enabled for all or specific card types accepted with this integration. This configuration in the UI is at the collection group level.

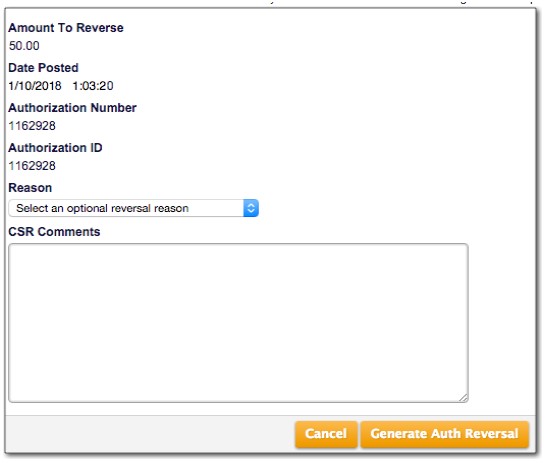

Vantiv also supports reversing pre-authorizations on credit cards outside of $0. After performing the authorization, click on accounts > search for the account > payments & credits (left panel) > current authorization reversals tab > create a new auth reversal. All pending authorizations that can be reversed display on this screen. Click the authorization ID for the authorization you want to reverse. A sample screen below will appear:

The reasons within the drop-down list are the following:

- Account charged in error

- Goods/Services not delivered

- Customer dissatisfaction

- Cancellation of pre-paid service

- Good will

- Overpayment/Duplicate payment

- Wrong/undesired payment source charged

- Other

After a reason is selected and CSR comment (optional) added, press Generate Auth Reversal to remove the pre-authorization on the credit card.

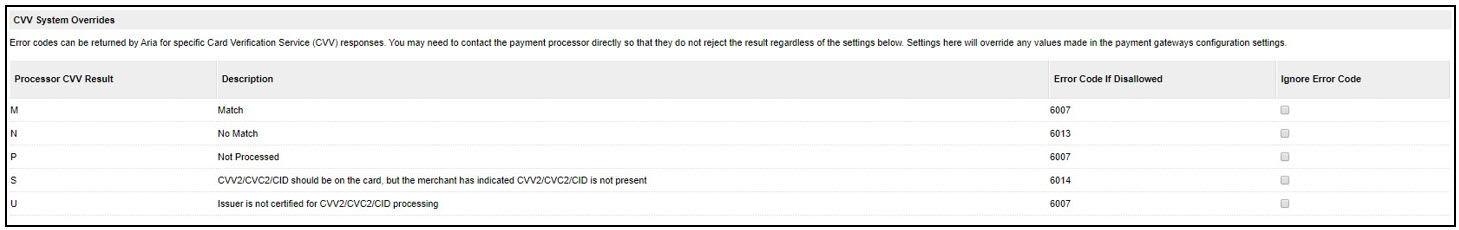

Card Verification Value (CVV)/Address Verification Service (AVS) Configuration

With the Vantiv integration, error codes can be returned by Aria for a specific Card Verification Value (CVV) response. This configuration lies within the collection groups and payment gateways tab in the UI (Configuration > Payments).

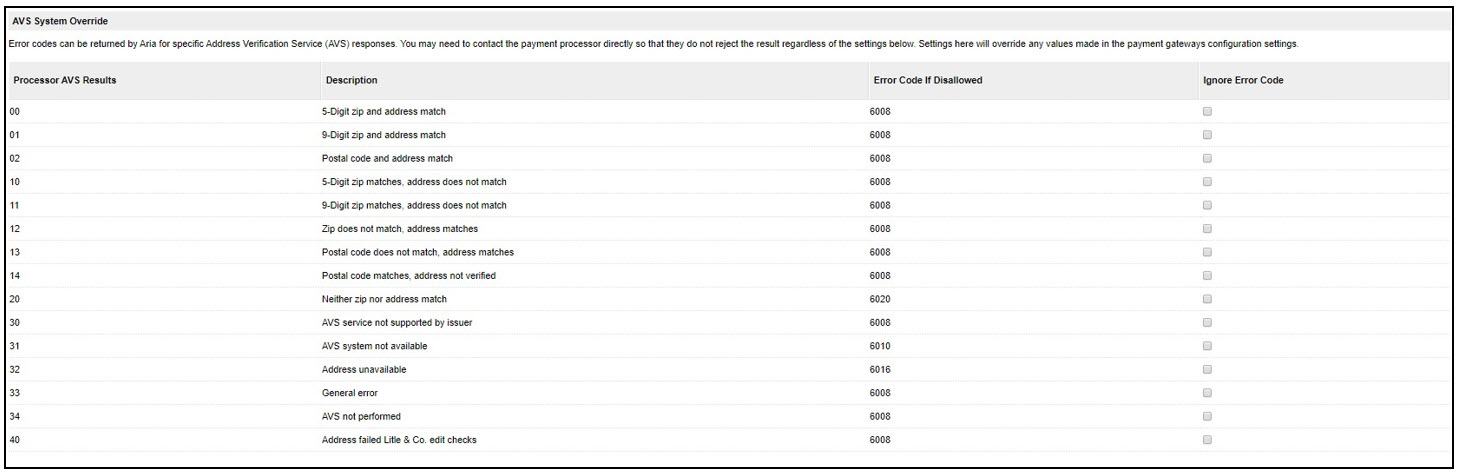

The integration with Vantiv also offers Address Verification Service responses. This configuration is also within the collection groups and payment gateways tab of the UI (Configuration > Payments). See image below for possible configuration options:

Mail Order/Telephone Order (MOTO) Enhancement

Aria has enhanced the Vantiv integration with support for the mail/telephone order (MOTO) transaction type. This means that you will not see the 3DS challenge when you make a purchase for a customer who is not physically present at your business location and:

- You call the authorize_electronic_payment_m API and you set the <transaction_type>

value to 1 and pass false into the <attempt_3d_secure> field; or In your Direct Post configuration, you set the Transaction Type field to Single transaction mail/telephone order (MOTO) and pass false into the <attempt_3d_secure> field in your Form of Payment page.

In your Direct Post configuration, Transaction Type is now a text-only field (as shown):

The following values can be entered at the Transaction Type field:

| Value | Description |

|---|---|

| -1 | Use client configuration settings for "Send Transaction Type as Recurring for Initial Request Where Possible" or "Send Transaction Type as Recurring for Subsequent Request" as applicable. |

| telephone | (Vantiv) The transaction is for a single telephone order. |

| mailorder | (Vantiv) The transaction is for a single mail order transaction. |

This applies to the following APIs:

- assign_acct_plan_m

- authorize_electronic_payment_m

- collect_from_account_m

- create_acct_billing_group_m

- create_acct_complete_m

- create_order_m

- create_order_with_plan_m

- manage_pending_invoice_m

- replace_acct_plan_m

- settle_account_balance_m

- update_acct_billing_group_m

- update_acct_complete_m

- update_acct_plan_m

- update_acct_plan_multi_m

- update_payment_method_m

- validate_acct_fraud_scoring_m

Response Code Enhancement

Aria’s Vantiv (Litle) payment integration previously only recognized response code 000 for a successful sale/auth transaction; now, Aria will treat 141 and 142 as codes for a successful sale/auth transaction also. This applies to the following pay methods: Credit Card, Tokenized Credit Card, and Merchant-Specific Gift Card.

Soft Failure Messaging Enhanced for Visa Card Transactions

For Vantiv, Aria has provided more detailed soft failure messaging for VISA card transactions. Declined transactions will indicate if the transaction is not supported by the card issuer or if a transaction is blocked, which necessitates contacting the cardholder (mapped to two new three-digit VAP codes, which stands for Visa Analytics Platform). Also, the two existing Decline error messages will be mapped to a new “Do Not Honor” VAP code.

The three new response codes are as follows:

| Code | Reason | Processor_ID |

|---|---|---|

| 192 | Do not Honor | 21 |

| 565 | Transaction not supported by issuer | 21 |

| 566 | Blocked by cardholder/contact cardholder | 21 |

Aria Configuration Fields

Getting Here: Add or edit a payment gateway and/or collection group.

- API Username: The API Username provided by Vantiv.

- API Password: The API Password provided by Vantiv.

- Merchant ID: The Merchant ID provided by Vantiv.

- Vantiv Reporting Group: Defines how the transactions appear in the Reporting UI. Depending on how you want to group the transactions you send, Vantiv can provide guidance on how best to name this field to fit your reporting needs.

- URL for Online Processing: The URL for Online Processing provided by Vantiv.

- URL for Batch Processing: The URL for Batch Processing provided by Vantiv.

- ThreatMatrix Prefix: A 5-character prefix provided by Vantiv.

- SFTP Host: Vantiv SFTP Host for sending/receiving Batch/Legacy Account Updater information.

- SFTP Account: Vantiv SFTP Account Name for sending/receiving Batch/Legacy Account Updater information.

- SFTP Password: Vantiv SFTP Account Password for sending/receiving Batch/Legacy Account Updater information.

- Send orderSource as recurring for all transactions: For any APIs that include the <recurring_processing_model_ind> input field, if you:

- Set Send orderSource as recurring for all transactions to Enabled, then Aria will automatically set <recurring_processing_model_ind> to 2 (Merchant-Initiated Transaction – Standing Instruction – Recurring).

- Set Send orderSource as recurring for all transactions to Disabled, then Aria will automatically set <recurring_processing_model_ind> to whatever value you pass into the <recurring_processing_model_ind> field.

Configuration Notes

- If you use Vantiv as your payment gateway and you plan to use tokenized credit cards as a payment method, you must enable the register token feature in Vantiv.

- The Vantiv Connector automatically pushes level 3 data for credit card transactions. If level 3 data is unavailable, Aria seamlessly degrades to sending only level 2 or level 1 data, as appropriate.