Once you have set up your tax service group, and mapped services to that tax service group, you must set up your taxation configuration. The taxation configuration sets specific attributes to your tax service group, such as associating countries in which you do business, start and end dates, service types, and rates.

Create Taxation Configuration

Overview

Note: Only one taxation configuration may be set up for each tax method. Within that taxation configuration, multiple tax sets may be created to accommodate different situations, as described in the Create Tax Sets section.

Setting Taxation Configuration

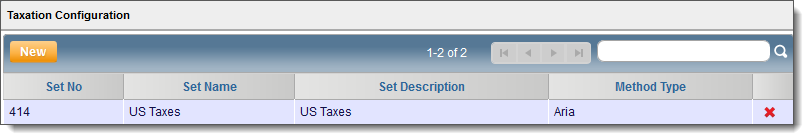

Getting Here: Click Configuration > Integrations > Taxation Configuration

Note: You can also edit an existing taxation configuration from this screen by clicking on a listed taxation configuration.

- Click the New button.

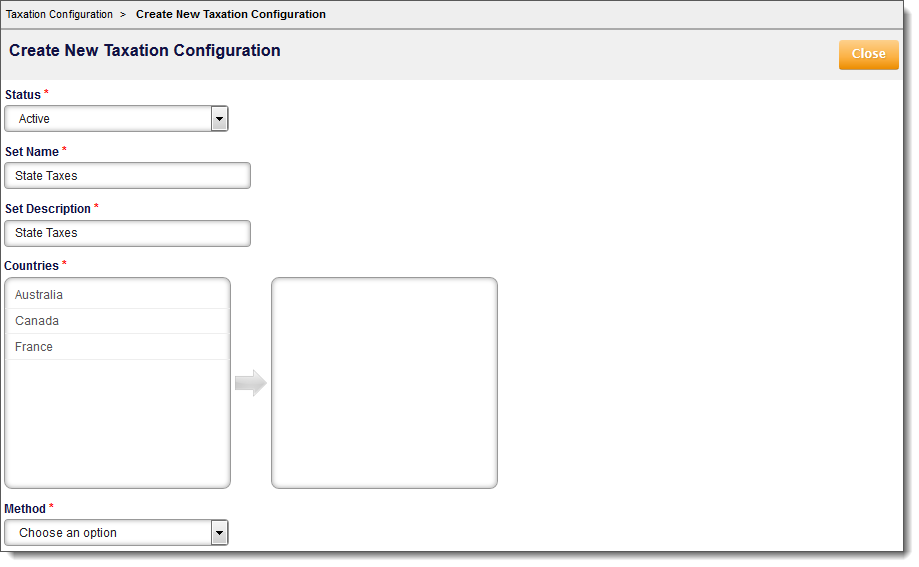

The Create New Taxation Configuration page displays.

- Select a Status indicator or use Active as the default. An Active status means that the tax is generated, and an Inactive status means that the tax is not generated.

- Enter a name for the taxation configuration in the Set Name field.

- Enter a brief description for the taxation configuration in the Set Description field.

- Select one or more countries that will use the tax method that you are configuring from the Countries section.

Note: All countries that you have configured in your environment, but have not yet associated with a tax method, display here. Once you have associated a country with a tax method, it no longer displays in this list as an option for new tax methods.

- Choose a tax method from the Method drop-down that you want to associate with the country or countries you have selected.

Note:You may only configure one instance of a tax method. Once you have configured a particular tax method, it is no longer available in this drop-down.

For example, you cannot create one configuration of the Aria internal tax engine to charge tax in the United States, then create another configuration of the Aria internal tax engine to charge tax in Canada. One configuration can accommodate both countries. You can modify any taxation configuration later, if necessary.

Once you choose a tax method, the configuration settings load and the Tax Group Configuration form populates below. It is very important to note that the form that populates is dependent on the tax method chosen. This means that the example given in the Create Tax Sets section may be different than the form you receive. For additional assistance, please see more on the third-party tax engine services Aria provides.

If you selected the Avalara, Sovos, or Vertex O-Series Method, then in the Tax Group Configuration section or any Configuration tab, you can specify the service location(s) associated with a bill-from or ship-from address for tax calculation. If you use any of the 3 tax engines mentioned above, you can also have taxes calculated based on a destination contact.

You can delete a taxation configuration at any time by clicking the red "X" next to the taxation configuration.