This article describes how to configure the Vertex O Series tax service.

Before You Begin

Make sure you have completed the tasks described in Set Up Taxes.

This article describes how to configure the Vertex O Series tax service.

Make sure you have completed the tasks described in Set Up Taxes.

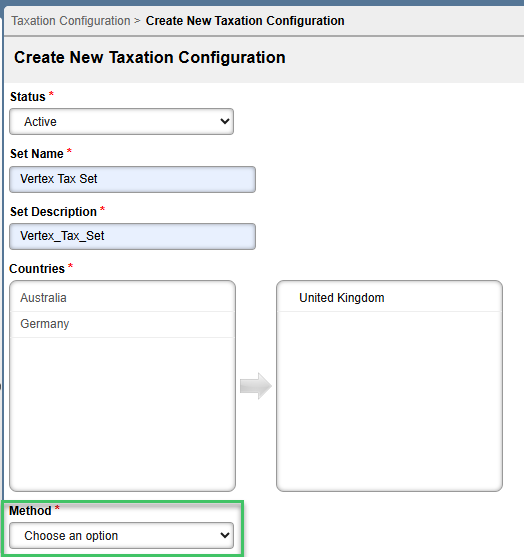

Getting Here: Configuration > Integrations > Taxation Configuration

For additional information, reference Create Taxation Configuration.

Note: Selected countries (in the right column) are the only countries that will be included for taxing in the Vertex O Series integration. All other countries (in the left column), are either taxed using another taxation method, or are not subject to any taxes.

Complete each section within the Tax Group Configuration based on the tax groups chosen. See below for information on what input is required for each section (for Aria Internal Taxation).

Configure the Tax Config Values section based on the tax groups chosen. For information on what input to provide for each field, see below.

Note: The Tax Config Value fields are at the client-level. If any information must be passed at the account level instead, then configure account supplemental fields and use the Supp Field Override field.

| Field Label | Definition |

|---|---|

| VertexURL | Full URL to the tax service |

| Login/UserName | Login username for Vertex API access |

| Login/Password | Login password for Vertex API access |

| Login/TrustedId | An identifier supplied by an Enterprise Resource Planning (ERP) module |

| Seller/Company | Identifies the top-level legal entity for which tax exceptions may exist (Supplemental Field override allowed—here). |

| Seller/Division | Identifies the mid-level legal entity for which tax exceptions may exist (Supplemental Field override allowed—here). |

| Seller/Department | Identifies the low-level legal entity for which tax exceptions may exist (Supplemental Field override allowed—here). |

| DocVersion | Vertex Document Version. Consult your Vertex representative for the correct document version. |

| Seller/TaxRegistrationNumber | Registration information for the Value Added Tax (VAT) |

| Customer/TaxRegistration/TaxRegistrationNumber | Registration information for VAT (Supplemental Field override allowed—here). |

| Customer/TaxRegistration/isoCountryCode | Registration country for VAT (Supplemental Field override allowed—here). |

| InvoiceRequest/Seller | Consult your Vertex representative for more information on the requirements for this field. |

| QuotationRequest/Seller | Consult your Vertex representative for more information on the requirements for this field. |

| Bill-From Address |

|

| Ship-From Address |

|

| Default Service Location for Bill-From address | Selecting a value from this drop-down auto-populates the Administrative Origin values based on the Service Location selected. |

| Default Location for Ship-From Address | Selecting a value from this drop-down auto-populates the Physical Origin values based on the Service Location selected. |

| Seller/AdministrativeOrigin/taxAreald | Vertex-specific number that identifies a tax area for the "bill-from" location. When provided, all other address fields will be ignored. |

| Seller/PhysicalOrigin/taxAreaId | Vertex-specific number that identifies a tax area for the location "ship-from" or "first removed" |

| Seller/AdministrativeOrigin/StreetAddress | Street address of the "bill-from" location |

| Seller/PhysicalOrigin/StreetAddress | Origin Street Address |

| Seller/AdministrativeOrigin/City | The name of the city of the "bill-from" location, used to determine the Tax Area ID if none is provided. |

| Seller/PhysicalOrigin/City | The name of the city that determines the Tax Area ID (if none is supplied). |

| Seller/AdministrativeOrigin/MainDivision | The name or the postal abbreviation of the state, province, or territory of the "bill-from" location used to determine the Tax Area ID if none is provided. |

| Seller/PhysicalOrigin/MainDivision | The name or postal abbreviation of the state, province, or territory used to determine the Tax Area ID if none is supplied. |

| Seller/AdministrativeOrigin/SubDivision | The name of the county of the "bill-from" location used to determine the Tax Area ID if none is provided. |

| Seller/PhysicalOrigin/SubDivision | The name of the county used to determine the Tax Area ID (if none is supplied). |

| Seller/AdministrativeOrigin/PostalCode | The postal code of the "bill-from" location used to determine the Tax Area ID if none is provided. |

| Seller/PhysicalOrigin/PostalCode | The postal code used to determine the Tax Area ID (if none is supplied). |

| Seller/AdministrativeOrigin/OriginCountry | The country of the "bill-from" location used to determine the Tax Area ID if none is provided. |

| Seller/PhysicalOrigin/Country | The country used to determine the Tax Area ID (if none is supplied). |

| Customer/CustomerCode | A code used to represent a customer, vendor, dispatcher or recipient (Supplemental Field override allowed—here). |

| CustomerCode/classCode: | A code used to represent groups of customers, vendors, dispatchers, or recipients who have similar taxability. |

| Destination/taxAreaId | Vertex-specific number that identifies a tax area for the location "ship-from" or "first removed" (Supplemental Field override allowed—here). |

| Destination/SubDivision | The name of the county used to determine the Tax Area ID if none is supplied. |

| FlexibleCodeFields | User-defined field for string values (Supplemental Field override allowed—here). |

| FlexibleNumericFields | User-defined field for double values. Consult your Vertex representative for more information on the requirements for this field (Supplemental Field override allowed—here). |

| FlexibleDateFields | User-defined field for date values. Consult your Vertex representative for more information on the requirements for this field (Supplemental Field override allowed—here). |

| IgnoreActionTypes | Setting this to "tax" results in no taxes being recorded in Aria. Setting this to "post refund" results in no line amounts being recorded in Vertex. |

| ApplicationData/Sender | Identifies the type of Application/Data being sent to the tax service. Please consult with your Vertex Account Representative for the appropriate values to enter for your business. |

| Include zero taxes in invoice tax detail |

|

| Skip Default Line Level Destinations |

|

| Seller/Utility Provider |

This has been added to provide additional taxation reporting internal to Vertex. Select from the following:

The Regulated value will only be sent if you choose; otherwise it will be sent as empty. There is no impact to taxation requests for existing clients. |

| Supp Field Override | Aria provides the ability to calculate taxes on the division and department levels at this field. After enabling the override, you can configure the Seller/Division and/or Seller/Department fields to calculate taxes based on account fields. This ensures that the legal entity/company hierarchy is maintained for tax calculation (drop-down values are populated based on account fields). |

| Posting date for Void |

|

| Posting date for Reversal |

|

| Posting date for Write Off |

|

| Posting date for Credit Memo |

|

| Allow Credits after 'x' days | When this parameter is configured, negative line items for credits are transmitted with the associated invoice for tax calculation purposes; this applies when a credit memo is processed after the period specified by this parameter. The default for Vertex is 90 days; this means that the credit memo can be processed as a new transaction with negative line items when the invoice date is older than 90 days. |