A rebill is a modified copy of an original invoice with adjusted charge amounts for various line items.

Rebill an Invoice

Overview

You cannot modify tax lines on a rebill. When a rebill is generated, the tax engine calculates any revised tax lines. You cannot perform a rebill on an invoice with usage that is taxed per-record.

When you create a rebill, you can adjust the rate to an amount other than the original charge. Rebilling an invoice automatically generates a credit memo to zero out the original invoice charges so the rebill can then replace it with modified charges.

The rebill uses the current payment method assigned to the billing group. If the billing group has changed since the initial invoice was created, any refunds go to the current payment method.

Notes:

- The best practice is to use the void invoice feature when you want to regenerate an invoice within the current billing cycle. For all previous billing cycles, we recommend that you only rebill invoices. Once you void an invoice you cannot rebill it.

- You cannot perform a rebill on an invoice with usage that is taxed per-record.

Rebill Configuration Settings

The following settings affect how rebills are processed and numbered. See each article for detailed information on these settings:

- Automatic Collection on Rebill: This setting determines whether a rebill automatically triggers a collection.

- Rebill Sequence Append Option: This setting controls whether rebills have a prefix or suffix added to the system-generated rebill number.

- Use Original Invoice Date for Rebill: This setting determines whether you use the original invoice date or the rebill date for dunning purposes. Rebill dates can be in the past, and this provides customers the option of using the rebill date or not.

- Rebill Sequence Number Source: This backend setting allows you to specify how Aria derives the Rebill sequence number.

Eligibility for Rebill

You cannot rebill any of the following types of invoices:

- Invoices that have any refund-related reversals

- Invoices that have already been voided

- Child invoices

- Pending invoices

- If any master plan instance on the original invoice has been removed from the billing group that it was in on the original invoice, the invoice cannot be rebilled.

Prerequisites

- In order to access the rebill feature, you must have access to it in the Aria application.

- To set the minimum CSR Level required to access the rebill feature, an authorized Aria application user can:

- Go to: Configuration > Security > Account Access > Statements & Invoices > Pages.

- Next to Rebill, select a Minimum CSR Level.

- Click Save.

- You must have at least one displayable Reason Code of type "Rebill," without which you cannot complete the Rebill process.

Rebilling an Invoice

Getting Here: Click Accounts > search for and select an account > Statements & Invoices > Invoices > select an invoice to rebill

- Click Rebill from the invoice detail screen.

The Rebill screen displays:

- Select a Reason Code for the rebill. This field is required. Note that only Reason Codes defined with a type of Rebill display in this drop-down menu.

- Enter information in the Comments field to explain the reason for the rebill. This field is required.

- You can optionally change the service to another service of the same type, within the same plan instance, by clicking Change.

Notes:

- You may not change an order-based or usage-based service.

- When you select a different service, the Units and Rate fields revert to zero, so you must enter the units and rate to successfully rebill the invoice.

- You can optionally change the values in the Units and Rate fields for each line item. When you are rebilling a charge that is not usage, the unit must be a whole number. The maximum rate amount cannot exceed the amount of the line item.

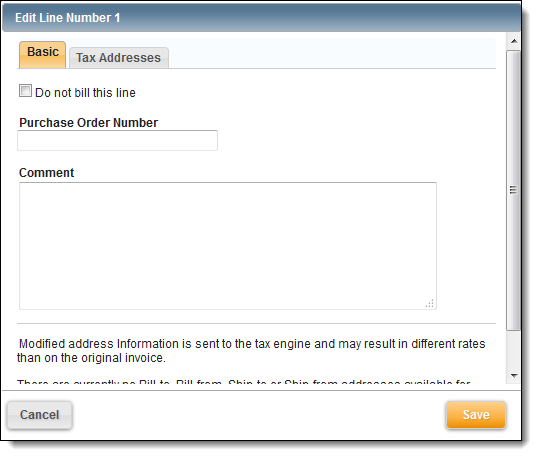

- Click the pencil icon to optionally add or change the purchase order number or the tax addresses for the line item. Note that changing the tax address can change the tax calculation for the rebill. Clicking this icon also displays a checkbox with the option Do not bill this line. Checking this option changes the units, rate, and amount to 0 and prevents further edits to the line until the box is unchecked.

- Click Next to continue. The details of the rebill are displayed.

- Click Save to continue. The rebill is saved, and a credit memo for the rebill amount is visible in the Credit Memos tab for the account.