If you have any accounts that are tax-exempt or international, you must set up corresponding account supplemental fields prior to your tax provider configuration.

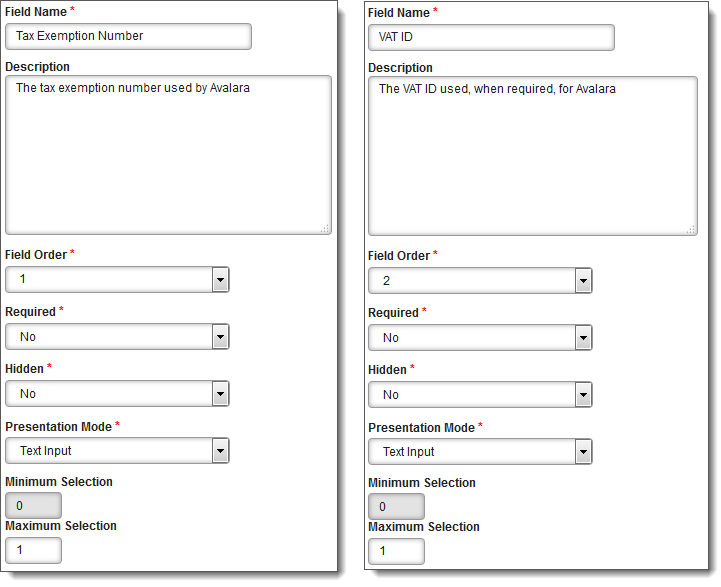

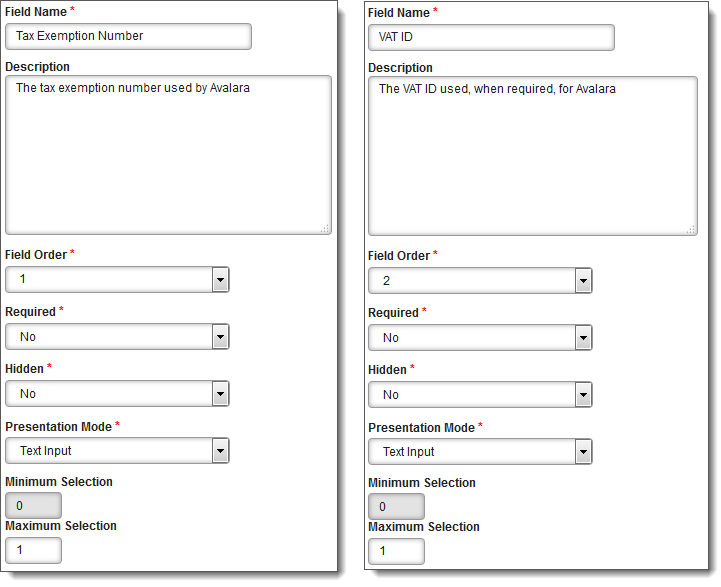

Follow the instructions within Create an Account Field to create account supplemental fields for the tax exemption number and for the VAT ID used by the tax provider (examples below).

Creating these supplemental account fields allows information on tax exempt and international accounts to be captured at the account level during your tax provider configuration.

Note: Not setting up these supplemental account fields, and filling in the ExemptionNo and BusinessIDNo fields within the Tax Config Values section of the tax provider configuration indicates that ALL accounts are tax exempt and that ALL accounts have the same VAT ID.