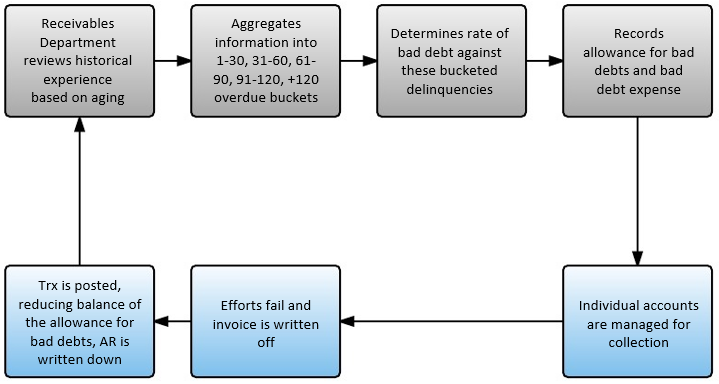

A write-off is an uncollectible debt from your accounts receivable that is performed upon the realization that payment likely will not be received on an account for tendered goods or services.

For instance, if a customer fails to make a payment on an invoice and you believe that the payment will not be received, you can create a write-off which reduces the previously recorded amount of the asset. Write-offs are often performed in conjunction with or after dunning as part of the collections process.

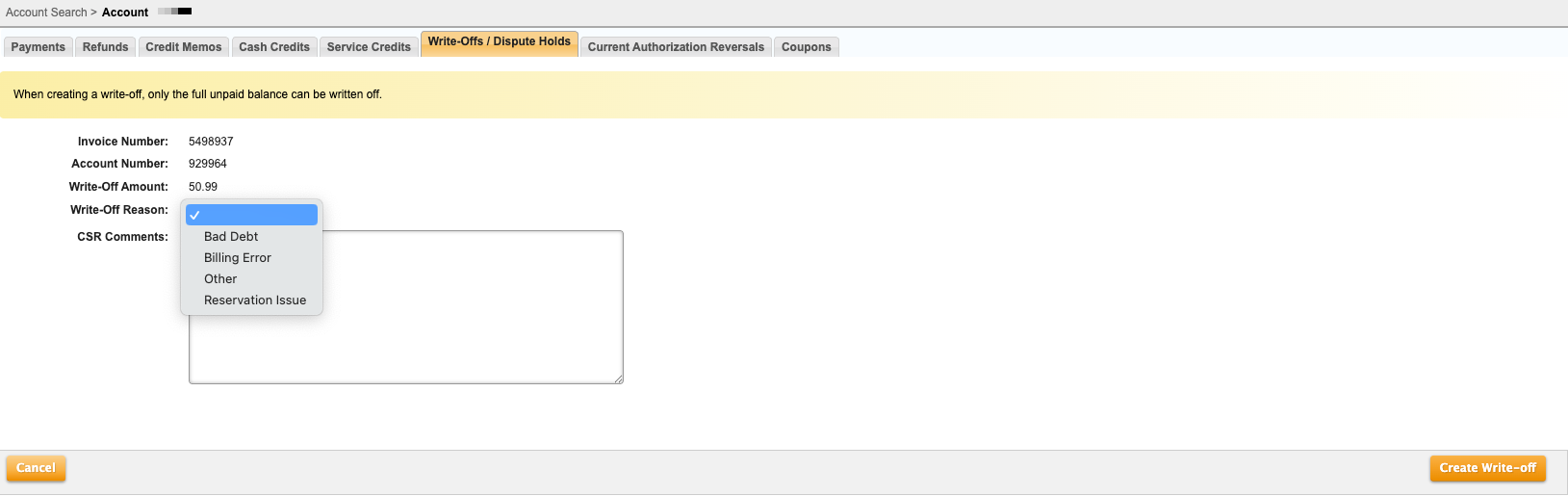

Currently, only the full unpaid balance may be written off via the Aria Billing Cloud UI. You can create a partial write-off/dispute via the API create_writeoff_or_dispute_m or in the Aria Customer Care Portal via [select an account] > Transactions > Write-Offs > Create New Write-Off > [select an invoice].

Note: The Aria Customer Care Portal allows you to create a write-off via [select an account] > Transactions > Write-Offs > Create New Write-Off > [select an invoice].

Note: If you offer installment terms to your customers, Aria suggests, as a best practice, you cancel the installment schedule before writing-off the remainder balance of an installment: otherwise, write-offs cause Aria to mark an active installment schedule's status as "Completed" and, if Installment Paid in Full notifications are enabled and the installment schedule is still active, Aria sends a customer an email indicating that the installment has been paid in full.

Creating a Write-Off

Getting Here: Click Accounts > search for an account > select an account > Payments & Credits > Write-Offs/Dispute Holds > Create a New Write-off.