There are several ways that Aria supports correcting usage records, based on your individual use case and where you are in your current billing cycle.

Best Practices for Correcting Usage Records

Correcting Usage Records

Discard Usage Records

To retain information, and for auditing purposes, usage records cannot be deleted. However, usage records can be discarded. Usage records that are discarded are excluded from invoicing (are not billed) and are also excluded from usage reports.

Discarded usage records cannot be reinstated and must be reloaded into the system if incorrectly discarded. Usage records can be discarded using either the UI or API. For more information on how to discard usage records and view discarded usage records in the UI, please reference Discard Usage.

If Statement is Already Invoiced and is Beyond Current Billing Term

If usage must be corrected for a statement that has already been invoiced and is beyond the current billing term (i.e. is not the most recent invoice that generated), a credit should be applied.

Cash Credit

Applying a cash credit is a best practice to correct usage records that have already been billed. Applying a cash credit functions most similarly to a refund in this use case since applying a cash credit immediately reduces a customer's current outstanding balance.

For more information on creating and applying cash credits, please reference Create a Cash Credit.

Service Credit

Applying a service credit is a best practice to correct usage if you would like the credit to be applied to a customer's future invoices. Aria's service credits can be applied to a selection of plans and services and can be configured to expire after a specific period of time. If applied to multiple plans (both master plans and supplemental plans) as well as to services, the credit may be allocated proportionately.

For more information on creating and applying service credits, please reference Create a Service Credit.

If Statement Has Invoice and is in Current Billing Term

If an invoice exists for the current billing cycle, either voiding or voiding and discarding the usage is a best practice to correct usage records.

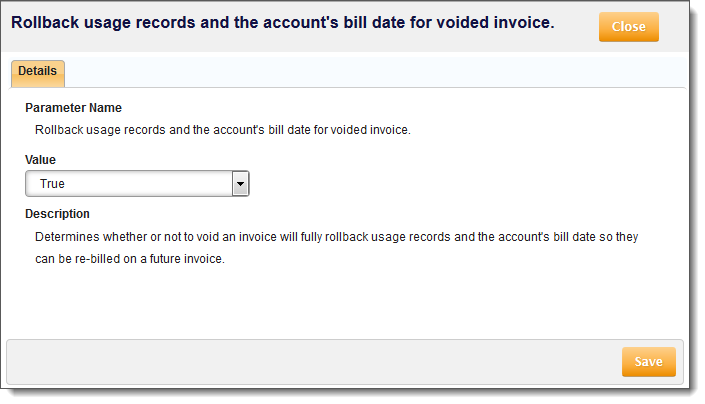

Note: For this method to apply, the Rollback Usage Records and the Account's Bill Date for Voided Invoice client parameter must already be set to True (before invoicing occurs).

Prerequisite

Getting Here: Click Configuration > Billing > Invoice Settings

- Select the Rollback Usage Records and the Account's Bill Date for Voided Invoice client setting.

- Select True from the Value drop-down.

Selecting True from this drop-down voids an invoice and will fully rollback usage records and the account's bill date so that they can be re-billed on a future date.

- Click Save.

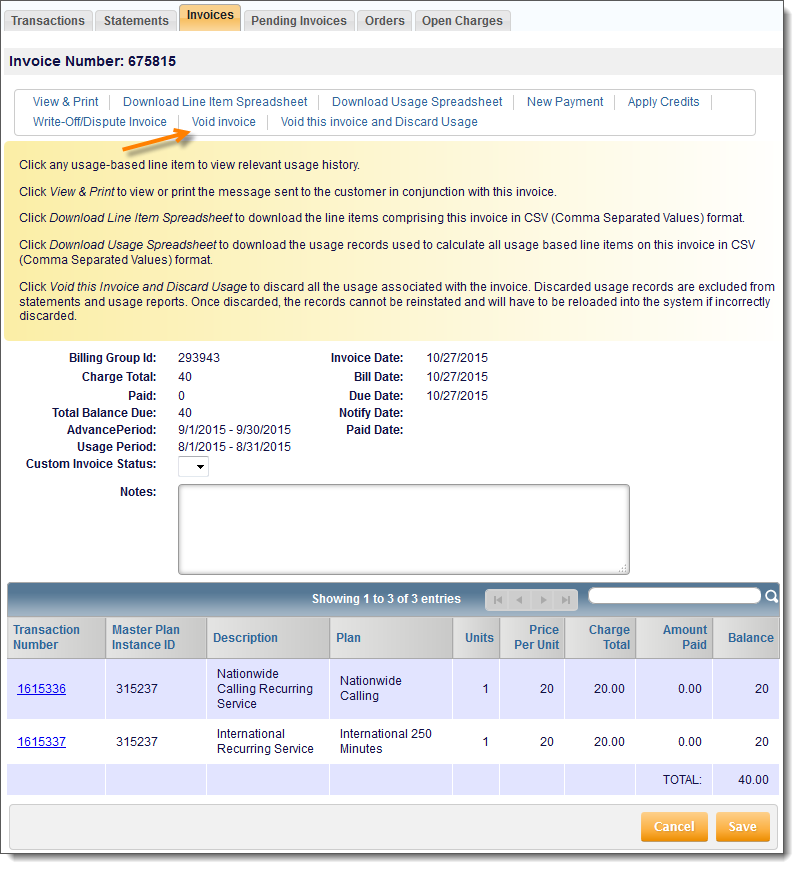

Void an Invoice

If usage needs to be corrected and an invoice exists for the current billing cycle, voiding the invoice reverts usage records to a unbilled state. These usage records will then be ready to be billed on the next invoice.

An invoice can be voided by selecting the Void invoice link on the applicable invoice.

Note: Once an invoice is voided, this action cannot be undone.

Once voided, you can discard the individual, now unbilled, usage records and reload the applicable usage records. For more information on discarding individual usage records, reference Discard Usage.

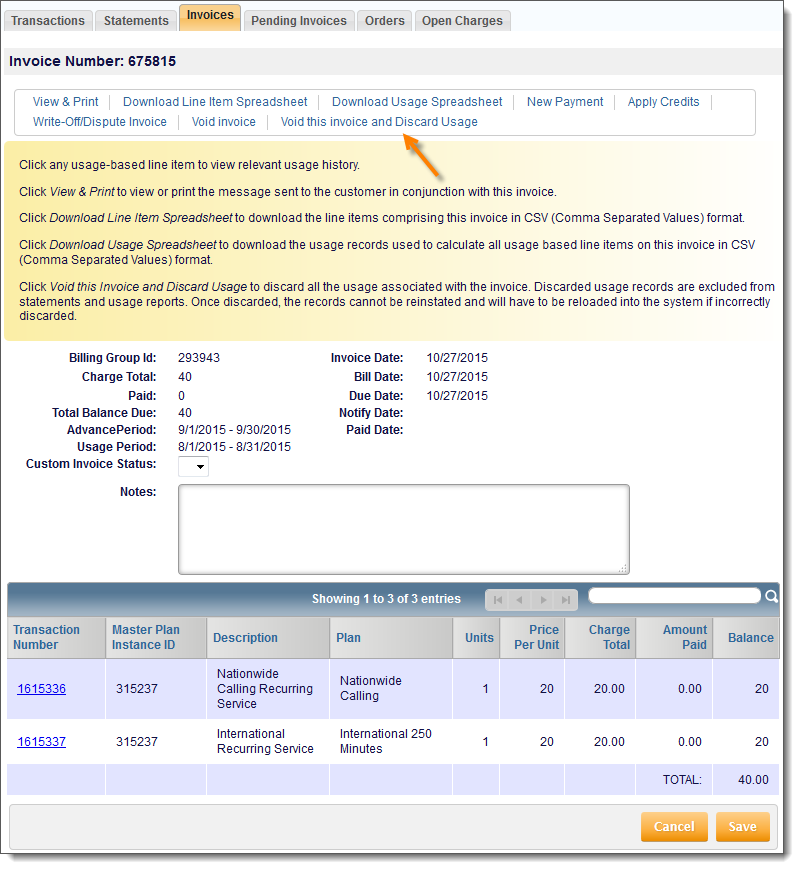

Void and Discard an Invoice

If an invoice exists for the current billing cycle and you would like to remove all usage records, you may want to void the invoice and discard all associated usage. You can do so by selecting the Void this invoice and Discard Usage link on the applicable invoice.

Note: Once an invoice is voided and the usage is discarded, this action cannot be undone.

Once the invoice is voided and all associated usage is discarded, you can reload all applicable usage. This may be a good best practice (over simply voiding an invoice, making usage records unbilled, and discarding individual records), because you can do a complete reload of records. Conversely, just voiding the invoice allows the flexibility to "cancel" and reload specific records.