Vertex Smart Tax

Aria adds Vertex to its Smart Tax integration for tax, post and void actions. Vertex is a global tax solution provider, and Vertex Smart Tax uses RestClient for more efficient interaction with Vertex APIs. Along with access token generation for streamlined tax processing, this integration also adds a custom request interceptor for handling file headers and logging, as well as a custom response error handler to manage API errors effectively. Vertex Smart Tax also includes implementing common tax data contracts for consistent tax processing. Additionally, refunds for full or partial amounts are supported, including tax distribution among both the refund and tax amounts. Geo actions based on Ship-From and Bill-From addresses are also supported.

To begin, access the Details tab to create your Tax Set Name and Description, along with associating a country for taxation:

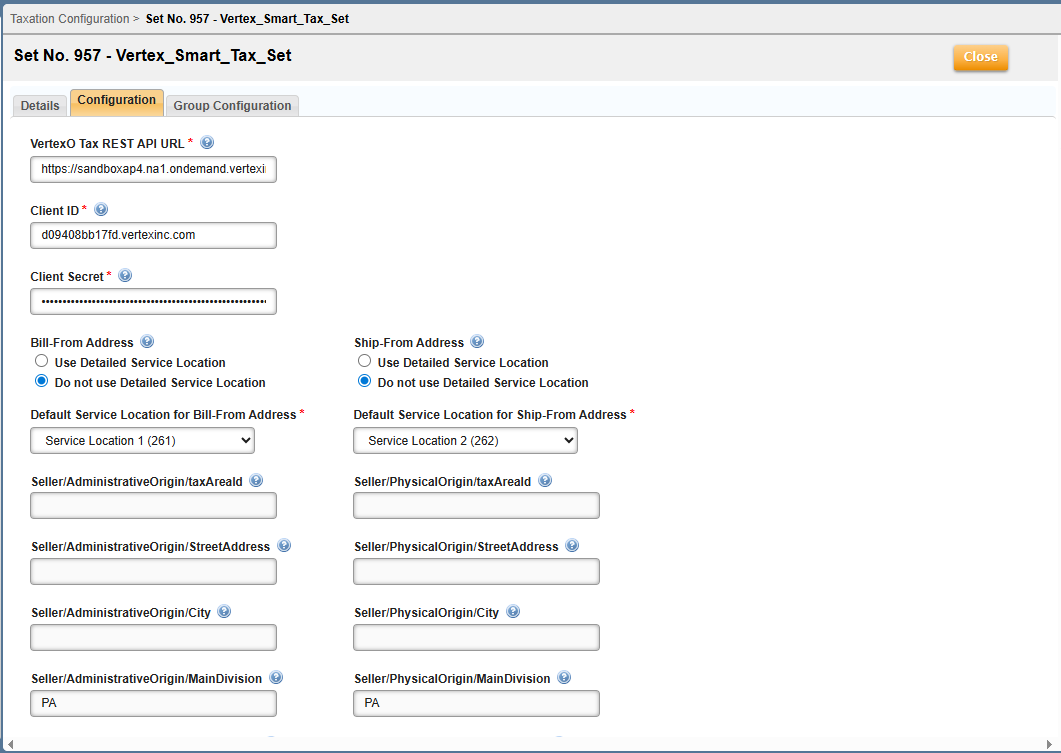

The Configuration tab follows:

For this tab, populate the following fields that have been added in support of the Vertex O Smart Tax taxation configuration:

| Field | Description |

|---|---|

| VertexO Tax REST API URL | Full URL for Vertex O Series REST API |

| Client Id | The name of the client used for calculating taxes |

| Client Secret | This is produced when registering the application. This field is masked in the Edit UI page. |

The following fields from Aria's legacy Vertex integration are also included as part of the tax request at this tab (fields do not appear in pic):

Configuration tab

| Field Label | Definition |

|---|---|

| Ship-From Address |

|

| Bill-From Address |

|

| FlexibleCodeFields[1-25] | User-defined field for string values (Supplemental Field override allowed—here). |

| FlexibleNumericFields[1-10] | User-defined field for double values. Consult your Vertex representative for more information on the requirements for this field (Supplemental Field override allowed—here). |

| FlexibleDateFields[1-5] | User-defined field for date values. Consult your Vertex representative for more information on the requirements for this field (Supplemental Field override allowed—here). |

| IgnoreActionTypes | Setting this to "tax" results in no taxes being recorded in Aria. Setting this to "post refund" results in no line amounts being recorded in Vertex. |

| Include zero taxes in invoice tax detail |

|

| Skip Default Line Level Destinations |

|

| Posting date for Void |

|

| Posting date for Reversal |

|

| Posting date for Write Off |

|

| Posting date for Credit Memo |

|

Access the Group Configuration tab as shown:

The following fields from Aria's legacy Vertex integration are also included as part of the tax request at this tab (for Aria Internal Taxation):

Group Configuration tab

| Field Label | Definition |

|---|---|

| LineItem/Product/productClass | Defines the line item or product. Consult your Vertex representative for more details. |

| Product/productClass | Defines the product class. Consult your Vertex representative for more details. |

| LineItem/LineType | Defines the line item and line type. Consult your Vertex representative for more details. |

| LineType/direction | Defines the line type and direction (selections are Inbound, Outbound or Two way). Consult your Vertex representative for more details. |

| LineType/content | Defines the line type and content (selections are Data, Voice or Both Data and Voice). Consult your Vertex representative for more details. |

| LineType/status | Defines the line type and content (selections are Active or Inactive). Consult your Vertex representative for more details. |

| Quantity/unitOfMeasure | Defines the line type and content (selections are Lines, Channel or Minutes). Consult your Vertex representative for more details. |

| CommodityCode/commodityCodeType | This is passed in both the Group (line item level) and Main (invoice level) configurations; the group level value takes precedence. The CommodityCode can be set at Products > Services and is passed on the invoice line item level. Both the Commodity Code and Commodity Code Type must be passed to utilize the Commodity Code feature. Vertex allows the following Commodity Code types: UNSPSC, NCM, Service, and HSN. If you use the Commodity Code Type field, contact Vertex about field values based on your use case or supported products or services (code is unique for international trading purposes). |

Press Save to retain your Vertex Smart Tax configuration.