Installment Terms Overview

Overview

This feature allows you to sell high-priced products to your customers by letting them choose to pay in installments. This provides the following benefits:

- For your customers: Makes expensive products more affordable by breaking the total cost into smaller payments.

- For you: Records the entire revenue from the sale upfront.

Key Concepts

Product Catalog

- Non-Subscription Offering (NSO) to Installment Terms is many-to-many. To avoid product catalog proliferation, You can map an installment term to many NSO products. In addition, a you can map multiple installment terms to a single NSO.

- 2 Types of Installment Terms:

- Aligned with master plan instance: installment schedule (bill/notify dates, due dates) is aligned with your master plan instance (associated with NSO) bill dates and be part of MPI anniversary statement (not part of prorated statement). This type of installment will always follow the Master Plan Instance (MPI) anniversary date and statement even when the MPI bill date is moved or adjusted.

- Independent: Installment schedule has its own bill/notify dates and due dates. Customers will be notified through a new communication class (IDR – installment due reminder) of the upcoming due amount. The new communication class batch called ‘Installment Schedule Due’ needs to be enabled by Aria Customer Support for existing clients. For new clients, the batch will be enabled automatically.

Account

- Installment Term is optional. It needs to be selected when a customer purchases an item or a Non-Subscription offering.

- Aria invoices the purchase once at the full amount, then creates an installment schedule at the time of invoice approval.

Note: If you do not require manual invoice approval, Aria automatically approves your invoices as part of its normal process.

- The installment schedule breaks down the full purchase price into installment-related invoice line items with multiple future due dates, due amounts, and notification dates. Each invoice line item with an installment term has its own installment schedule.

Note: Aria suggests, as a best practice, you cancel the installment schedule before writing-off the remainder balance of an installment: otherwise, write-offs cause Aria to mark an active installment schedule's status as "Completed" and, if Installment Paid in Full notifications are enabled and the installment schedule is still active, Aria sends a customer an email indicating that the installment has been paid in full.

- Enhanced Payment Collection and Payment Application. Payment collection logic excludes the collection of installments due in the future. The payment application integrates with your existing payment settings configuration or options: First-Due-First-Out, First-In-First-Out and Statement First-In-First-Out.

- Compatibility. The Installment feature is compatible with coupons as well as various order billing options.

Installment Term Flowchart

The following flowchart presents an end-to-end process flow for both aligned and independent installments:

Process Flow Steps

- Customer Selects Installment Plan

During the purchase process, customers will have the option to opt-in for an installment term mapped to an NSO product. This gives them the flexibility to choose a payment option that works best for them. - Customer Invoiced for Full Amount

When a customer makes a purchase, an order will be created and invoiced for the full amount of the product (depending on bill order option: immediately or in the future). - Aria Creates Installment Schedule

This schedule outlines the details of each installment, including the amount due, due dates, notify dates, and payment status. - Aria Sends Customer Communication

Depending on the type of installments, Aria notifies customers of the upcoming installments due via their anniversary statement (for aligned installment) or via email for a new email template class Installment Due Reminder (IDR) for an independent installment.

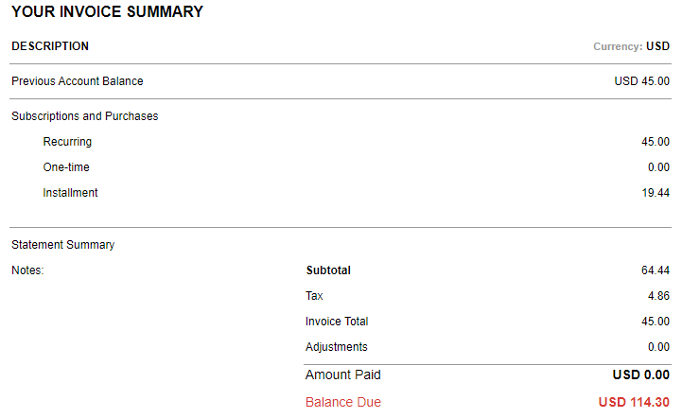

Sample of aligned installment communication:

- Aria Collects Payments

Aria collects payments based on the installment schedule, either manually or automatically (depending on the payment method configured for the billing group). - Aria Evaluates Past Due Installment for Dunning

When an installment due becomes past due, Aria evaluates it for dunning. If the past due balance is over the dunning threshold, Aria puts the the master plan instance (MPI or subscription) into dunning.