You can void a refund transaction using the void_transaction_m API, but you cannot cancel a refund disbursement. When you void a refund transaction, there is no instruction to the payment processor to reverse the refund. Therefore, it is not recommended that you do this for refunds processed through a payment processor.

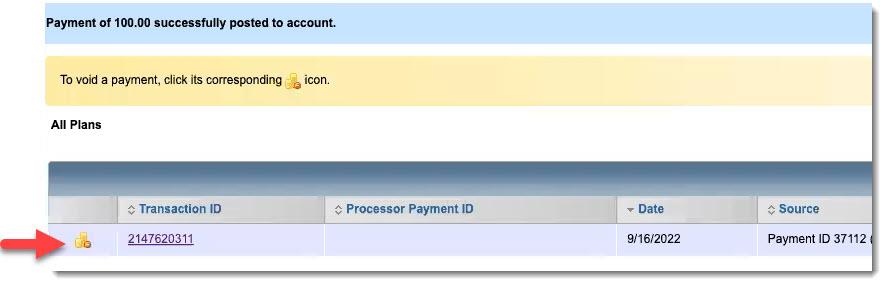

A void reverses a transaction in Aria. There is no reversal in external systems unless the client initiates it externally. For the type of refund that creates a new charge line, you can void the payment on a charge using the Delete icon next to the transaction as shown below: