One Source Smart Tax

Aria introduces OneSource as the initial taxation provider included in Aria's Smart Tax integration. OneSource is a leading service for businesses seeking to achieve full tax compliance while maximizing deductions with minimum risk of audits and disruption of operations. OneSource Smart Tax supports tax, post, void, and refund actions through the Aria UI and existing APIs.

Getting Here: Click Configuration > Integrations > Taxation Configuration

- Click New to set up a OneSource taxation configuration.

- Fill out all the required fields of a new taxation configuration (i.e., Status, Set Name, Set Description, and Countries).

- Select OneSource Indirect Tax from the Method drop-down list.

The following fields are included (Configuration > Integrations > Taxation Configuration > OneSource > Configuration tab):

Tax Group Configuration

- LineItem/ProductCode—This allows you to specify the product code for each line item to be sent to OneSource during the taxation process.

Tax Config Values

- OneSource Tax REST API URL—The full URL to the REST API configured for OneSource

- Client id—The client ID configured for OneSource

- Client Secret—The secret string used to identify the client

- External Company Id—The external company ID configured for OneSource

- Company Role—A dropdown list to identify the company role (Buyer, Middleman and Seller)

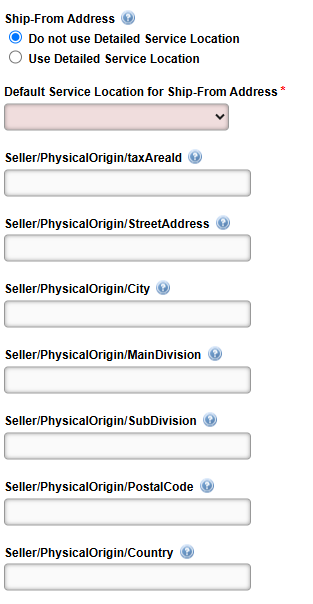

- Ship-From Address—Select whether or not you wish to use a detailed service location by clicking the applicable radio button.

- When Do not use Detailed Service Location is selected:

- The standard Service Location (values for the fields listed on this screen) will be used as the Ship-From address for all invoice line items.

-

When Use Default Service Location is selected:

-

If a Service Location is associated with a service for a given plan instance on the account or with an item purchased as part of a one-time order, that Service Location will be used as the Ship-From (physical origin) address for the corresponding invoice line items.

-

Otherwise, if a Service Location is associated with a service in the product catalog, that Service Location will be used as the Ship-From address for the corresponding invoice line items.

-

If no Service Location is found based on the above criteria, then the standard Service Location (values for the fields listed on this screen) will be used as the Ship-From address for the remaining invoice line items.

-

- When Do not use Detailed Service Location is selected:

-

Default Service Location for Ship-From Address—Select your service location from the drop-down list.

-

Seller/Physical/Origin/taxAreaid—The specific number that identifies a tax area for the "Ship-From" or first removed location. When provided, all other address fields will be ignored.

-

Seller/Physical/Origin/StreetAddress—The street address of the Ship-From location.

-

Seller/Physical/Origin/City—The name of the city of the Ship-From location used to determine the Tax Area ID if none is provided.

-

Seller/Physical/Origin/MainDivision—The name of the postal abbreviation of the state, province or territory of the Ship-From location used to determine the Tax Area ID if none is provided.

-

Seller/Physical/Origin/SubDivision—The name of the county of the Ship-From location used to determine the Tax Area ID if none is provided.

-

Seller/Physical/Origin/PostalCode—The postal code of the Ship-From location used to determine the Tax Area ID if none is provided.

-

Seller/Physical/Origin/Country—The country of the Ship-From location used to determine the Tax Area ID if none is provided.

Click Save to add your OneSource tax configuration.

Notes:

- OneSource Smart Tax supports a maximum of 22,000 taxable invoice lines.

- The legacy Aria OneSource tax engine will be renamed to Sabrix.

- Special characters (non-ASCII) are not supported at this time.