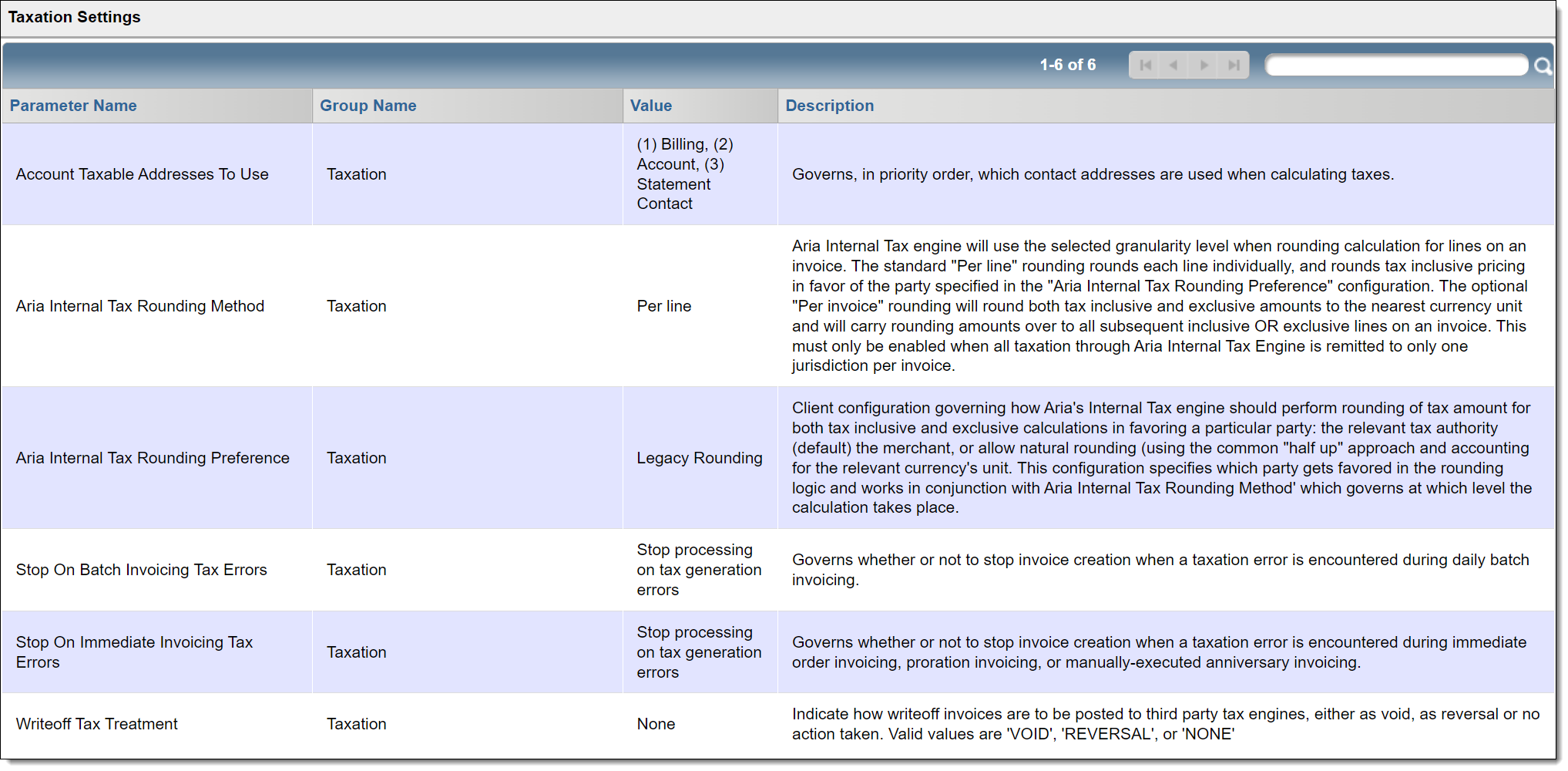

Your taxation settings determine how the system processes tax calculations during invoicing, such as which address will be used to calculate taxes due from customers.

Taxation Settings

Overview

Note: It is recommended that you use the default value if the setting does not apply.

Taxation Settings

Getting Here: Configuration > Billing > Taxation Settings

Below is a list of taxation settings, their descriptions, default values, and where the parameter can be set in the user interface.

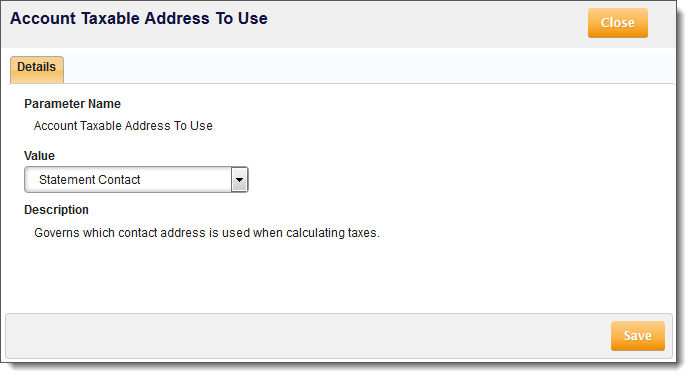

Changing Taxation Settings

Getting Here: Configuration > Billing > Taxation Settings

- Click the Taxation Setting you would like to edit.

The details of the setting displays in a new window

- Choose a new option from the Value drop-down, if applicable (see descriptions in the overview section above).

- Click Save.

Note: If you do not have any changes, clicking Close at the top of the screen will cancel any changes.