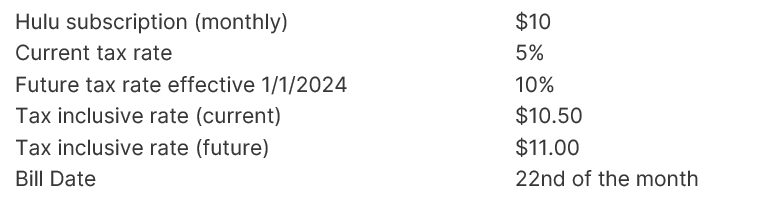

A6-APP DEV-11157 Prorated Credits Tax Update r53 wk

Update on Taxation Applied to Prorated Credits (DEV-11157)

For Aria clients and partners, we wish to inform you that we will implement an update on taxation applied to prorated credits for Release R53 (targeted Production release date of October 26th, 2023). Starting in R53, prorated credits created by the system due to subscription changes (i.e., cancellation, downgrades, etc.) will be taxed at the same tax rate as its original invoice. The tax date sent to the tax engines (Aria and Aria’s partners) for a prorated credit will be equal to the tax date of its original invoice. Prior to R53, prorated credits were taxed with the tax rate in effect at the time of credit creation.

See examples below for taxation scenarios before and after R53:

Use Case: Cancellation post tax rate change.

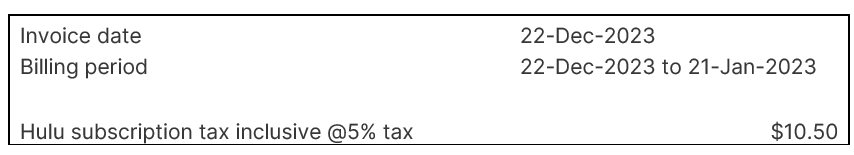

Customer will be billed the following invoice:

On January 2, 2024, a customer called to cancel.

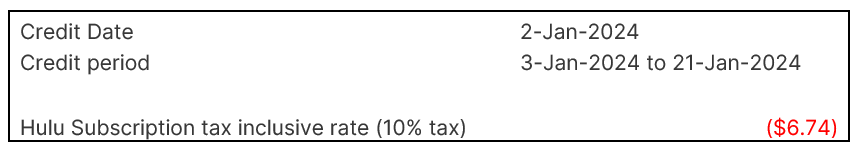

Before R53:

Prorated credit will be calculated with tax rate in effect on January 2, 2024 (10%). Tax date is January 2, 2024.

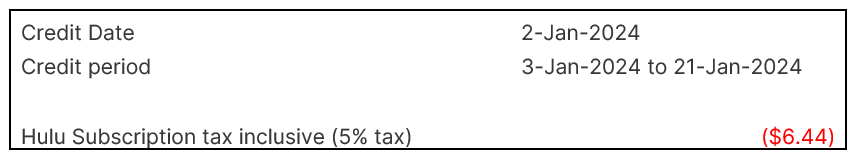

After R53:

Prorated credit will be calculated with the same tax rate as its original invoice (5%). Tax date is December 22, 2023.

The change is more compliant with the current standard for global taxation. Please contact your Aria representative if you require additional information.